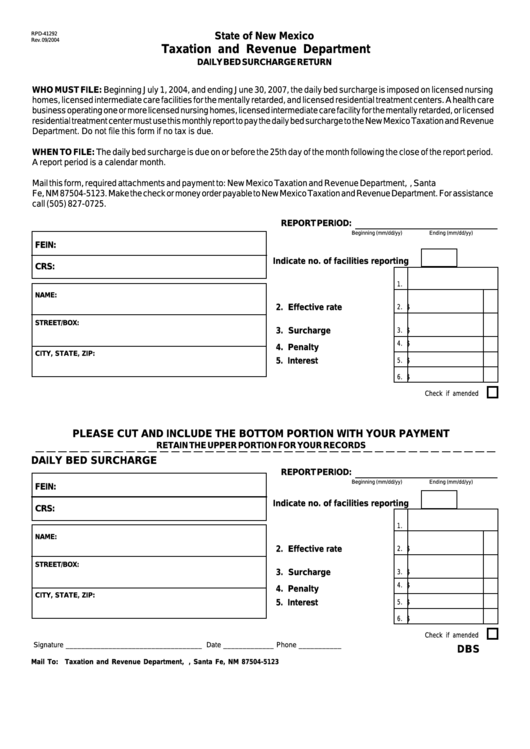

RPD-41292

State of New Mexico

Rev. 09/2004

Taxation and Revenue Department

DAILY BED SURCHARGE RETURN

WHO MUST FILE: Beginning July 1, 2004, and ending June 30, 2007, the daily bed surcharge is imposed on licensed nursing

homes, licensed intermediate care facilities for the mentally retarded, and licensed residential treatment centers. A health care

business operating one or more licensed nursing homes, licensed intermediate care facility for the mentally retarded, or licensed

residential treatment center must use this monthly report to pay the daily bed surcharge to the New Mexico Taxation and Revenue

Department. Do not file this form if no tax is due.

WHEN TO FILE: The daily bed surcharge is due on or before the 25th day of the month following the close of the report period.

A report period is a calendar month.

Mail this form, required attachments and payment to: New Mexico Taxation and Revenue Department, P.O. Box 25123, Santa

Fe, NM 87504-5123. Make the check or money order payable to New Mexico Taxation and Revenue Department. For assistance

call (505) 827-0725.

REPORT PERIOD:

Beginning (mm/dd/yy)

Ending (mm/dd/yy)

FEIN:

Indicate no. of facilities reporting

CRS:

1.

1. No. occupied bed days

NAME:

2.

$

2. Effective rate

STREET/BOX:

3.

$

3. Surcharge

4.

$

4. Penalty

CITY, STATE, ZIP:

5.

$

5. Interest

6.

$

6. Total due

Check if amended

PLEASE CUT AND INCLUDE THE BOTTOM PORTION WITH YOUR PAYMENT

RETAIN THE UPPER PORTION FOR YOUR RECORDS

DAILY BED SURCHARGE

REPORT PERIOD:

Beginning (mm/dd/yy)

Ending (mm/dd/yy)

FEIN:

Indicate no. of facilities reporting

CRS:

1. No. occupied bed days

1.

NAME:

2.

$

2. Effective rate

STREET/BOX:

3.

$

3. Surcharge

4.

$

4. Penalty

CITY, STATE, ZIP:

5.

$

5. Interest

6.

$

6. Total due

Check if amended

Signature ___________________________________ Date _____________ Phone ___________

DBS

Mail To:

Taxation and Revenue Department, P.O. Box 25123, Santa Fe, NM 87504-5123

1

1 2

2