Instructions For Form Dp-165 - Research & Development Tax Credit Application - New Hampshire Department Of Revenue Administration

ADVERTISEMENT

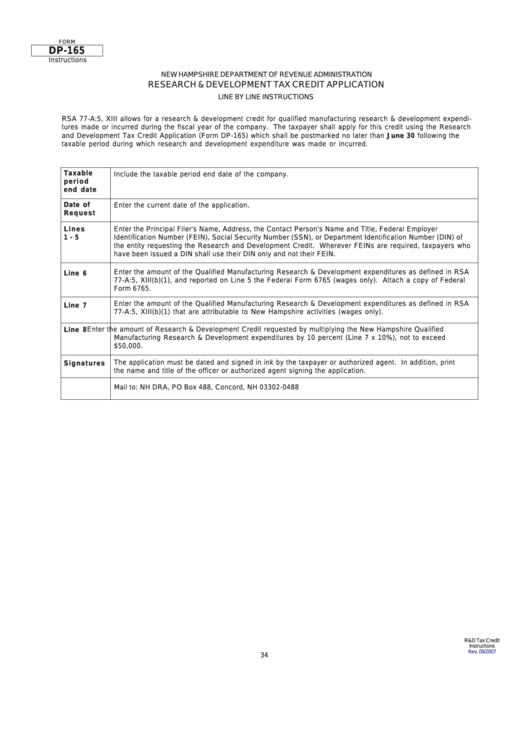

FORM

DP-165

Instructions

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

RESEARCH & DEVELOPMENT TAX CREDIT APPLICATION

LINE BY LINE INSTRUCTIONS

RSA 77-A:5, XIII allows for a research & development credit for qualified manufacturing research & development expendi-

tures made or incurred during the fiscal year of the company. The taxpayer shall apply for this credit using the Research

and Development Tax Credit Application (Form DP-165) which shall be postmarked no later than June 30 following the

taxable period during which research and development expenditure was made or incurred.

Taxable

Include the taxable period end date of the company.

p e r i o d

end date

Date of

.

Enter the current date of the application

Request

Lines

Enter the Principal Filer's Name, Address, the Contact Person's Name and Title, Federal Employer

1 - 5

Identification Number (FEIN), Social Security Number (SSN), or Department Identification Number (DIN) of

the entity requesting the Research and Development Credit. Wherever FEINs are required, taxpayers who

have been issued a DIN shall use their DIN only and not their FEIN.

Enter the amount of the Qualified Manufacturing Research & Development expenditures as defined in RSA

Line 6

77-A:5, XIII(b)(1), and reported on Line 5 the Federal Form 6765 (wages only). Attach a copy of Federal

Form 6765.

Enter the amount of the Qualified Manufacturing Research & Development expenditures as defined in RSA

Line 7

77-A:5, XIII(b)(1) that are attributable to New Hampshire activities (wages only).

Enter the amount of Research & Development Credit requested by multiplying the New Hampshire Qualified

Line 8

Manufacturing Research & Development expenditures by 10 percent (Line 7 x 10%), not to exceed

$50,000.

The application must be dated and signed in ink by the taxpayer or authorized agent. In addition, print

Signatures

the name and title of the officer or authorized agent signing the application.

Mail to: NH DRA, PO Box 488, Concord, NH 03302-0488

R&D Tax Credit

Instructions

Rev. 09/2007

34

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1