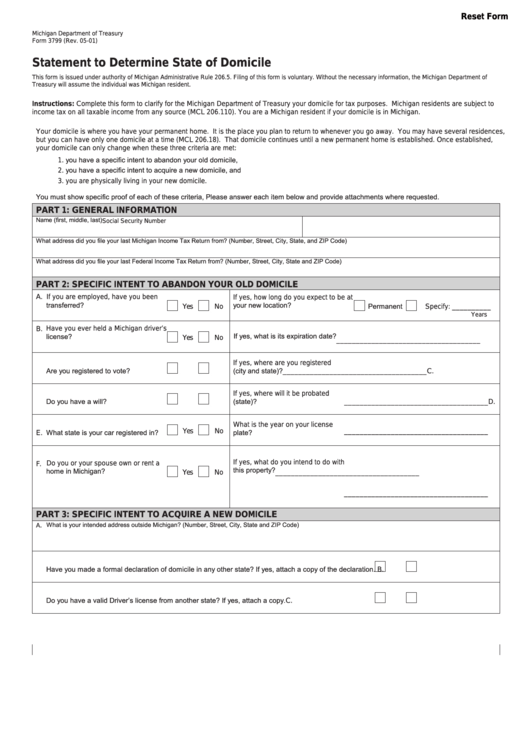

Reset Form

Michigan Department of Treasury

Form 3799 (Rev. 05-01)

Statement to Determine State of Domicile

This form is issued under authority of Michigan Administrative Rule 206.5. Filing of this form is voluntary. Without the necessary information, the Michigan Department of

Treasury will assume the individual was Michigan resident.

Instructions: Complete this form to clarify for the Michigan Department of Treasury your domicile for tax purposes. Michigan residents are subject to

income tax on all taxable income from any source (MCL 206.110). You are a Michigan resident if your domicile is in Michigan.

Your domicile is where you have your permanent home. It is the place you plan to return to whenever you go away. You may have several residences,

but you can have only one domicile at a time (MCL 206.18). That domicile continues until a new permanent home is established. Once established,

your domicile can only change when these three criteria are met:

1. you have a specific intent to abandon your old domicile,

2. you have a specific intent to acquire a new domicile, and

3. you are physically living in your new domicile.

You must show specific proof of each of these criteria, Please answer each item below and provide attachments where requested.

PART 1: GENERAL INFORMATION

Name (first, middle, last)

Social Security Number

What address did you file your last Michigan Income Tax Return from? (Number, Street, City, State, and ZIP Code)

What address did you file your last Federal Income Tax Return from? (Number, Street, City, State and ZIP Code)

PART 2: SPECIFIC INTENT TO ABANDON YOUR OLD DOMICILE

A. If you are employed, have you been

If yes, how long do you expect to be at

transferred?

your new location?

Permanent

Yes

No

Specify:

__________

Years

B. Have you ever held a Michigan driver’s

If yes, what is its expiration date?

license?

Yes

No

_____________________________________

If yes, where are you registered

Are you registered to vote?

Yes

No

(city and state)?

C.

_____________________________________

If yes, where will it be probated

Do you have a will?

Yes

No

(state)?

D.

_____________________________________

What is the year on your license

What state is your car registered in?

Yes

No

plate?

_____________________________________

E.

If yes, what do you intend to do with

F. Do you or your spouse own or rent a

this property?

home in Michigan?

Yes

No

_____________________________________

_____________________________________

PART 3: SPECIFIC INTENT TO ACQUIRE A NEW DOMICILE

What is your intended address outside Michigan? (Number, Street, City, State and ZIP Code)

.

A

Have you made a formal declaration of domicile in any other state? If yes, attach a copy of the declaration.

Yes

No

B.

Do you have a valid Driver’s license from another state? If yes, attach a copy.

Yes

No

C.

1

1 2

2