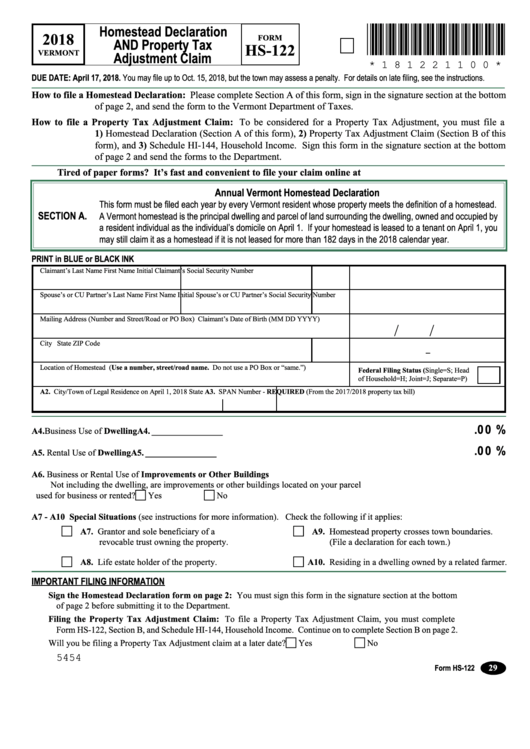

Homestead Declaration

*181221100*

2018

FORM

AND Property Tax

HS-122

VERMONT

Adjustment Claim

* 1 8 1 2 2 1 1 0 0 *

DUE DATE: April 17, 2018. You may file up to Oct. 15, 2018, but the town may assess a penalty. For details on late filing, see the instructions.

How to file a Homestead Declaration: Please complete Section A of this form, sign in the signature section at the bottom

of page 2, and send the form to the Vermont Department of Taxes.

How to file a Property Tax Adjustment Claim: To be considered for a Property Tax Adjustment, you must file a

1) Homestead Declaration (Section A of this form), 2) Property Tax Adjustment Claim (Section B of this

form), and 3) Schedule HI-144, Household Income. Sign this form in the signature section at the bottom

of page 2 and send the forms to the Department.

Tired of paper forms? It’s fast and convenient to file your claim online at

Annual Vermont Homestead Declaration

This form must be filed each year by every Vermont resident whose property meets the definition of a homestead.

SECTION A.

A Vermont homestead is the principal dwelling and parcel of land surrounding the dwelling, owned and occupied by

a resident individual as the individual’s domicile on April 1. If your homestead is leased to a tenant on April 1, you

may still claim it as a homestead if it is not leased for more than 182 days in the 2018 calendar year.

PRINT in BLUE or BLACK INK

Claimant’s Last Name

First Name

Initial

Claimant’s Social Security Number

Spouse’s or CU Partner’s Last Name

First Name

Initial

Spouse’s or CU Partner’s Social Security Number

Mailing Address (Number and Street/Road or PO Box)

Claimant’s Date of Birth (MM DD YYYY)

/

/

City

State

ZIP Code

-

Location of Homestead (Use a number, street/road name. Do not use a PO Box or “same.”)

Federal Filing Status (Single=S; Head

of Household=H; Joint=J; Separate=P)

A2. City/Town of Legal Residence on April 1, 2018

State

A3. SPAN Number - REQUIRED (From the 2017/2018 property tax bill)

.0 0 %

A4. Business Use of Dwelling . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A4. ________________

.0 0 %

A5. Rental Use of Dwelling . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A5. ________________

A6. Business or Rental Use of Improvements or Other Buildings

Not including the dwelling, are improvements or other buildings located on your parcel

used for business or rented? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

c

c

A7 - A10 Special Situations (see instructions for more information). Check the following if it applies:

A7. Grantor and sole beneficiary of a

A9. Homestead property crosses town boundaries.

c

c

revocable trust owning the property.

(File a declaration for each town.)

A8. Life estate holder of the property.

A10. Residing in a dwelling owned by a related farmer.

c

c

IMPORTANT FILING INFORMATION

Sign the Homestead Declaration form on page 2: You must sign this form in the signature section at the bottom

of page 2 before submitting it to the Department.

Filing the Property Tax Adjustment Claim: To file a Property Tax Adjustment Claim, you must complete

Form HS-122, Section B, and Schedule HI-144, Household Income. Continue on to complete Section B on page 2.

Will you be filing a Property Tax Adjustment claim at a later date? . . . . . . .

Yes

No

c

c

5454

29

Form HS-122

1

1 2

2 3

3 4

4