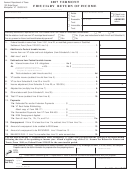

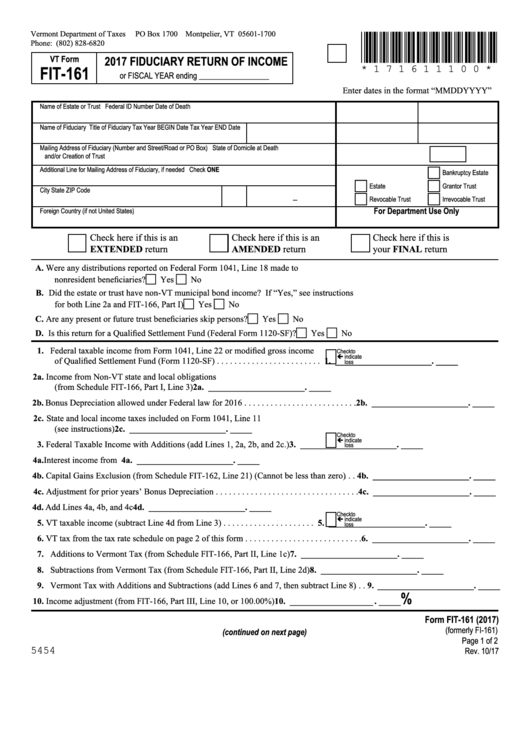

Vermont Department of Taxes

PO Box 1700 Montpelier, VT 05601-1700

*171611100*

Phone: (802) 828-6820

2017 FIDUCIARY RETURN OF INCOME

VT Form

FIT-161

* 1 7 1 6 1 1 1 0 0 *

or FISCAL YEAR ending __________________

Enter dates in the format “MMDDYYYY”

Name of Estate or Trust

Federal ID Number

Date of Death

Name of Fiduciary

Title of Fiduciary

Tax Year BEGIN Date

Tax Year END Date

Mailing Address of Fiduciary (Number and Street/Road or PO Box)

State of Domicile at Death

and/or Creation of Trust

Check ONE

Additional Line for Mailing Address of Fiduciary, if needed

c

Bankruptcy Estate

c

c

Estate

Grantor Trust

City

State

ZIP Code

-

c

c

Revocable Trust

Irrevocable Trust

For Department Use Only

Foreign Country (if not United States)

Check here if this is an

Check here if this is an

Check here if this is

EXTENDED return

AMENDED return

your FINAL return

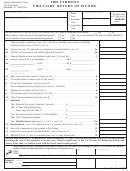

A.

Were any distributions reported on Federal Form 1041, Line 18 made to

nonresident beneficiaries? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

c

c

B.

Did the estate or trust have non-VT municipal bond income? If “Yes,” see instructions

for both Line 2a and FIT-166, Part I) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

c

c

C.

Are any present or future trust beneficiaries skip persons? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

c

c

D.

Is this return for a Qualified Settlement Fund (Federal Form 1120-SF)? . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

c

c

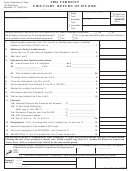

1.

Federal taxable income from Form 1041, Line 22 or modified gross income

Check to

ç indicate

of Qualified Settlement Fund (Form 1120-SF) . . . . . . . . . . . . . . . . . . . . . . . .

1. ______________________. _____

loss

2a.

Income from Non-VT state and local obligations

(from Schedule FIT-166, Part I, Line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a. ______________________. _____

2b.

Bonus Depreciation allowed under Federal law for 2016 . . . . . . . . . . . . . . . . . . . . . . . . . .2b. ______________________. _____

2c.

State and local income taxes included on Form 1041, Line 11

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c. ______________________. _____

Check to

ç indicate

3.

3. ______________________. _____

Federal Taxable Income with Additions (add Lines 1, 2a, 2b, and 2c.) . . . . . .

loss

4a.

Interest income from U.S. obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4a. ______________________. _____

4b.

Capital Gains Exclusion (from Schedule FIT-162, Line 21) (Cannot be less than zero) . . .4b. ______________________. _____

4c.

Adjustment for prior years’ Bonus Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4c. ______________________. _____

4d.

Add Lines 4a, 4b, and 4c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4d. ______________________. _____

Check to

ç indicate

5.

5. ______________________. _____

VT taxable income (subtract Line 4d from Line 3) . . . . . . . . . . . . . . . . . . . . .

loss

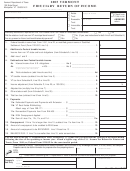

6.

VT tax from the tax rate schedule on page 2 of this form . . . . . . . . . . . . . . . . . . . . . . . . . . .6. ______________________. _____

7.

Additions to Vermont Tax (from Schedule FIT-166, Part II, Line 1c) . . . . . . . . . . . . . . . . . .7. ______________________. _____

8.

Subtractions from Vermont Tax (from Schedule FIT-166, Part II, Line 2d) . . . . . . . . . . . . .8. ______________________. _____

9.

Vermont Tax with Additions and Subtractions (add Lines 6 and 7, then subtract Line 8) . . . 9. ______________________. _____

%

10.

Income adjustment (from FIT-166, Part III, Line 10, or 100.00%) . . . . . . . . . . . . . . . . . . .10. ___________________ . _____

Form FIT-161 (2017)

(formerly FI-161)

(continued on next page)

Page 1 of 2

5454

Rev. 10/17

1

1 2

2