Clear This Page

2014

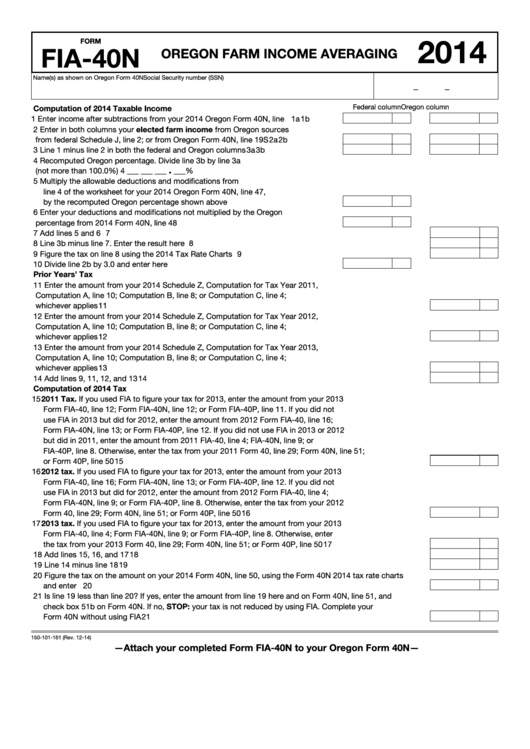

FORM

FIA-40N

OREGON FARM INCOME AVERAGING

Name(s) as shown on Oregon Form 40N

Social Security number (SSN)

—

—

Federal column

Oregon column

Computation of 2014 Taxable Income

1 Enter income after subtractions from your 2014 Oregon Form 40N, line 38.............. 1a

1b

2 Enter in both columns your elected farm income from Oregon sources

from federal Schedule J, line 2; or from Oregon Form 40N, line 19S ......................... 2a

2b

3 Line 1 minus line 2 in both the federal and Oregon columns ..................................... 3a

3b

4 Recomputed Oregon percentage. Divide line 3b by line 3a

.

(not more than 100.0%)

4 ___ ___ ___

___%

.....................................................................................................

5 Multiply the allowable deductions and modifications from

line 4 of the worksheet for your 2014 Oregon Form 40N, line 47,

by the recomputed Oregon percentage shown above ................................................. 5

6 Enter your deductions and modifications not multiplied by the Oregon

percentage from 2014 Form 40N, line 48 ..................................................................... 6

7 Add lines 5 and 6 ................................................................................................................................................ 7

8 Line 3b minus line 7. Enter the result here ........................................................................................................ 8

9 Figure the tax on line 8 using the 2014 Tax Rate Charts .................................................................................... 9

10 Divide line 2b by 3.0 and enter here ...........................................................................10

Prior Years’ Tax

11 Enter the amount from your 2014 Schedule Z, Computation for Tax Year 2011,

Computation A, line 10; Computation B, line 8; or Computation C, line 4;

whichever applies ............................................................................................................................................... 11

12 Enter the amount from your 2014 Schedule Z, Computation for Tax Year 2012,

Computation A, line 10; Computation B, line 8; or Computation C, line 4;

whichever applies ............................................................................................................................................... 12

13 Enter the amount from your 2014 Schedule Z, Computation for Tax Year 2013,

Computation A, line 10; Computation B, line 8; or Computation C, line 4;

whichever applies ............................................................................................................................................... 13

14 Add lines 9, 11, 12, and 13 ................................................................................................................................. 14

Computation of 2014 Tax

15 2011 Tax. If you used FIA to figure your tax for 2013, enter the amount from your 2013

Form FIA-40, line 12; Form FIA-40N, line 12; or Form FIA-40P, line 11. If you did not

use FIA in 2013 but did for 2012, enter the amount from 2012 Form FIA-40, line 16;

Form FIA-40N, line 13; or Form FIA-40P, line 12. If you did not use FIA in 2013 or 2012

but did in 2011, enter the amount from 2011 FIA-40, line 4; FIA-40N, line 9; or

FIA-40P, line 8. Otherwise, enter the tax from your 2011 Form 40, line 29; Form 40N, line 51;

or Form 40P, line 50 ............................................................................................................................................ 15

16 2012 tax. If you used FIA to figure your tax for 2013, enter the amount from your 2013

Form FIA-40, line 16; Form FIA-40N, line 13; or Form FIA-40P, line 12. If you did not

use FIA in 2013 but did for 2012, enter the amount from 2012 Form FIA-40, line 4;

Form FIA-40N, line 9; or Form FIA-40P, line 8. Otherwise, enter the tax from your 2012

Form 40, line 29; Form 40N, line 51; or Form 40P, line 50 ................................................................................. 16

17 2013 tax. If you used FIA to figure your tax for 2013, enter the amount from your 2013

Form FIA-40, line 4; Form FIA-40N, line 9; or Form FIA-40P, line 8. Otherwise, enter

the tax from your 2013 Form 40, line 29; Form 40N, line 51; or Form 40P, line 50 ............................................ 17

18 Add lines 15, 16, and 17 ..................................................................................................................................... 18

19 Line 14 minus line 18 .......................................................................................................................................... 19

20 Figure the tax on the amount on your 2014 Form 40N, line 50, using the Form 40N 2014 tax rate charts

and enter here..................................................................................................................................................... 20

21 Is line 19 less than line 20? If yes, enter the amount from line 19 here and on Form 40N, line 51, and

check box 51b on Form 40N. If no, STOP: your tax is not reduced by using FIA. Complete your

Form 40N without using FIA ............................................................................................................................... 21

150-101-161 (Rev. 12-14)

—Attach your completed Form FIA-40N to your Oregon Form 40N—

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9