Corrected Final 10/31/13

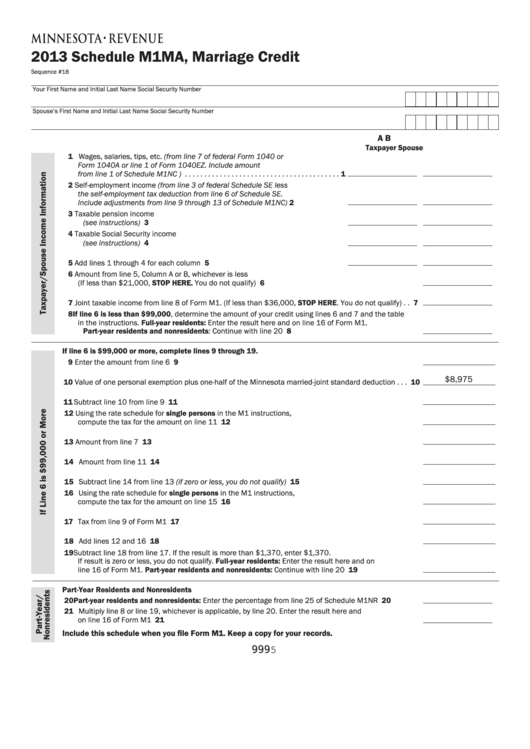

2013 Schedule M1MA, Marriage Credit

Sequence #18

Your First Name and Initial

Last Name

Social Security Number

Spouse’s First Name and Initial

Last Name

Social Security Number

A

B

Taxpayer

Spouse

1 Wages, salaries, tips, etc. (from line 7 of federal Form 1040 or

Form 1040A or line 1 of Form 1040EZ. Include amount

from line 1 of Schedule M1NC ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Self-employment income (from line 3 of federal Schedule SE less

the self-employment tax deduction from line 6 of Schedule SE.

Include adjustments from line 9 through 13 of Schedule M1NC) . . . . . . . . . . . . . 2

3 Taxable pension income

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Taxable Social Security income

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Add lines 1 through 4 for each column . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Amount from line 5, Column A or B, whichever is less

(If less than $21,000, STOP HERE. You do not qualify) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Joint taxable income from line 8 of Form M1. (If less than $36,000, STOP HERE. You do not qualify) . . 7

8 If line 6 is less than $99,000, determine the amount of your credit using lines 6 and 7 and the table

in the instructions. Full-year residents: Enter the result here and on line 16 of Form M1.

Part-year residents and nonresidents: Continue with line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

If line 6 is $99,000 or more, complete lines 9 through 19.

9 Enter the amount from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

$8,975

10 Value of one personal exemption plus one-half of the Minnesota married-joint standard deduction . . . 10

11 Subtract line 10 from line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Using the rate schedule for single persons in the M1 instructions,

compute the tax for the amount on line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Amount from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Amount from line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Subtract line 14 from line 13 (if zero or less, you do not qualify) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Using the rate schedule for single persons in the M1 instructions,

compute the tax for the amount on line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Tax from line 9 of Form M1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Add lines 12 and 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Subtract line 18 from line 17. If the result is more than $1,370, enter $1,370.

If result is zero or less, you do not qualify. Full-year residents: Enter the result here and on

line 16 of Form M1. Part-year residents and nonresidents: Continue with line 20 . . . . . . . . . . . . . . . . 19

Part-Year Residents and Nonresidents

20 Part-year residents and nonresidents: Enter the percentage from line 25 of Schedule M1NR . . . . . . 20

21 Multiply line 8 or line 19, whichever is applicable, by line 20. Enter the result here and

on line 16 of Form M1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

Include this schedule when you file Form M1. Keep a copy for your records.

9995

1

1 2

2