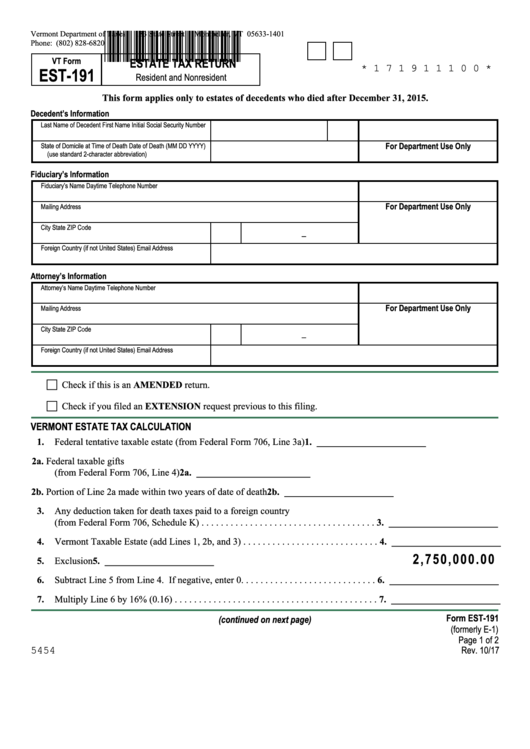

Vermont Department of Taxes

133 State Street

Montpelier, VT 05633-1401

*171911100*

Phone: (802) 828-6820

VT Form

ESTATE TAX RETURN

* 1 7 1 9 1 1 1 0 0 *

EST-191

Resident and Nonresident

This form applies only to estates of decedents who died after December 31, 2015.

Decedent’s Information

Last Name of Decedent

First Name

Initial

Social Security Number

For Department Use Only

State of Domicile at Time of Death

Date of Death (MM DD YYYY)

(use standard 2-character abbreviation)

Fiduciary’s Information

Fiduciary’s Name

Daytime Telephone Number

For Department Use Only

Mailing Address

City

State

ZIP C

de

o

-

Foreign Country (if not United States)

Email Address

Attorney’s Information

Attorney’s Name

Daytime Telephone Number

For Department Use Only

Mailing Address

City

State

ZIP C

de

o

-

Foreign Country (if not United States)

Email Address

Check if this is an AMENDED return .

Check if you filed an EXTENSION request previous to this filing .

VERMONT ESTATE TAX CALCULATION

1.

Federal tentative taxable estate (from Federal Form 706, Line 3a) . . . . . . . . . . . . . . 1. _______________________

2a.

Federal taxable gifts

(from Federal Form 706, Line 4) . . . . . . . . . . . . . 2a. ________________________

2b.

Portion of Line 2a made within two years of date of death . . . . . . . . . . . . . . . . . . . 2b. _______________________

3.

Any deduction taken for death taxes paid to a foreign country

(from Federal Form 706, Schedule K) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. _______________________

4.

Vermont Taxable Estate (add Lines 1, 2b, and 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. _______________________

2 ,750, 000. 00

5.

Exclusion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. _______________________

6.

Subtract Line 5 from Line 4 . If negative, enter 0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. _______________________

7.

Multiply Line 6 by 16% (0 .16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. _______________________

Form EST-191

(continued on next page)

(formerly E-1)

Page 1 of 2

5454

Rev. 10/17

1

1 2

2