*171171100*

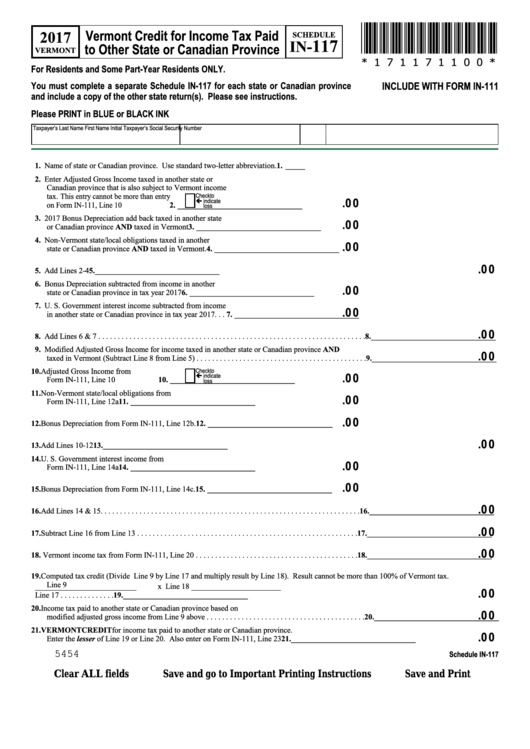

Vermont Credit for Income Tax Paid

2017

SCHEDULE

117

IN-

to Other State or Canadian Province

VERMONT

* 1 7 1 1 7 1 1 0 0 *

For Residents and Some Part-Year Residents ONLY.

You must complete a separate Schedule IN-117 for each state or Canadian province

INCLUDE WITH FORM IN-111

and include a copy of the other state return(s). Please see instructions.

Please PRINT in BLUE or BLACK INK

Taxpayer’s Last Name

First Name

Initial

Taxpayer’s Social Security Number

1. Name of state or Canadian province. Use standard two-letter abbreviation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1. _____

2. Enter Adjusted Gross Income taxed in another state or

Canadian province that is also subject to Vermont income

tax. This entry cannot be more than entry

Check to

.0 0

ç indicate

on Form IN-111, Line 10 . . . . . . . . . . . . . . .

2. ________________________________

loss

3. 2017 Bonus Depreciation add back taxed in another state

.0 0

or Canadian province AND taxed in Vermont . . . . . . . . . . 3. ________________________________

4. Non-Vermont state/local obligations taxed in another

.0 0

state or Canadian province AND taxed in Vermont. . . . . . 4. ________________________________

.0 0

5. Add Lines 2-4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5.________________________________

6. Bonus Depreciation subtracted from income in another

.0 0

state or Canadian province in tax year 2017 . . . . . . . . . . . . 6. ________________________________

7. U. S. Government interest income subtracted from income

.0 0

in another state or Canadian province in tax year 2017 . . . 7. ________________________________

.0 0

8. Add Lines 6 & 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8.________________________________

9. Modified Adjusted Gross Income for income taxed in another state or Canadian province AND

.0 0

taxed in Vermont (Subtract Line 8 from Line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9.________________________________

10. Adjusted Gross Income from

Check to

.0 0

ç indicate

Form IN-111, Line 10 . . . . . . . . . . . . . . . . .

10. ________________________________

loss

11. Non-Vermont state/local obligations from

.0 0

Form IN-111, Line 12a . . . . . . . . . . . . . . . . . . . . . . . . . . . 11. ________________________________

.0 0

12. Bonus Depreciation from Form IN-111, Line 12b. . . . . . 12. ________________________________

.0 0

13. Add Lines 10-12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13.________________________________

14. U. S. Government interest income from

.0 0

Form IN-111, Line 14a . . . . . . . . . . . . . . . . . . . . . . . . . . . 14. ________________________________

.0 0

15. Bonus Depreciation from Form IN-111, Line 14c. . . . . . . 15. ________________________________

.0 0

16. Add Lines 14 & 15. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .16.________________________________

.0 0

17. Subtract Line 16 from Line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .17.________________________________

.0 0

18. Vermont income tax from Form IN-111, Line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .18.________________________________

19. Computed tax credit (Divide Line 9 by Line 17 and multiply result by Line 18). Result cannot be more than 100% of Vermont tax.

Line 9

__________________________

x Line 18 _______________________

.0 0

Line 17

. . . . . . . . . . . . . .19.________________________________

20. Income tax paid to another state or Canadian province based on

.0 0

modified adjusted gross income from Line 9 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .20.________________________________

21. VERMONT CREDIT for income tax paid to another state or Canadian province.

.0 0

Enter the lesser of Line 19 or Line 20. Also enter on Form IN-111, Line 23 . . . . . . . . . . . . . . . . . . . . .21.________________________________

5454

Schedule IN-117

Clear ALL fields

Save and go to Important Printing Instructions

Save and Print

1

1