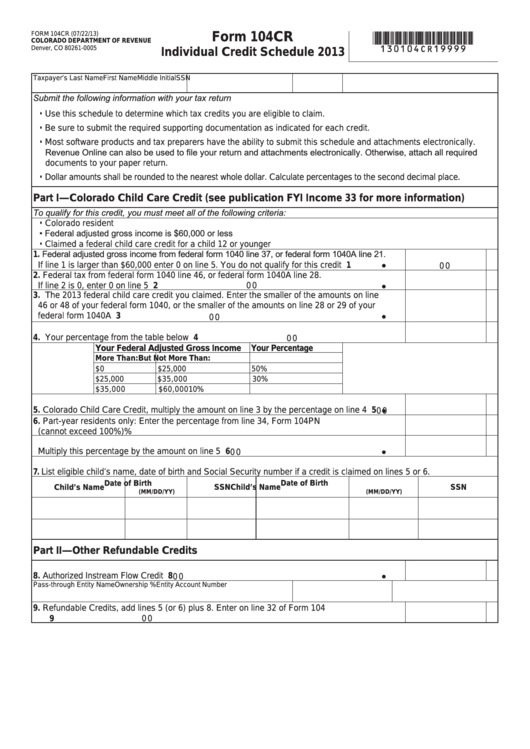

FORM 104CR (07/22/13)

Form 104CR

*130104CR19999*

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0005

Individual Credit Schedule 2013

Taxpayer’s Last Name

First Name

Middle Initial

SSN

Submit the following information with your tax return

• Use this schedule to determine which tax credits you are eligible to claim.

• Be sure to submit the required supporting documentation as indicated for each credit.

• Most software products and tax preparers have the ability to submit this schedule and attachments electronically.

Revenue Online can also be used to file your return and attachments electronically. Otherwise, attach all required

documents to your paper return.

• Dollar amounts shall be rounded to the nearest whole dollar. Calculate percentages to the second decimal place.

Part I—Colorado Child Care Credit (see publication FYI Income 33 for more information)

To qualify for this credit, you must meet all of the following criteria:

• Colorado resident

• Federal adjusted gross income is $60,000 or less

• Claimed a federal child care credit for a child 12 or younger

Federal adjusted gross income from federal form 1040 line 37, or federal form 1040A line 21.

1.

If line 1 is larger than $60,000 enter 0 on line 5. You do not qualify for this credit

1

0 0

2. Federal tax from federal form 1040 line 46, or federal form 1040A line 28.

If line 2 is 0, enter 0 on line 5

2

0 0

3.

The 2013 federal child care credit you claimed. Enter the smaller of the amounts on line

46 or 48 of your federal form 1040, or the smaller of the amounts on line 28 or 29 of your

federal form 1040A

3

0 0

4. Your percentage from the table below

4

0 0

Your Federal Adjusted Gross Income

Your Percentage

More Than:

But Not More Than:

$0

$25,000

50%

$25,000

$35,000

30%

$35,000

$60,000

10%

5.

Colorado Child Care Credit, multiply the amount on line 3 by the percentage on line 4

5

0 0

6.

Part-year residents only: Enter the percentage from line 34, Form 104PN

(cannot exceed 100%)

%

Multiply this percentage by the amount on line 5

6

0 0

7.

List eligible child’s name, date of birth and Social Security number if a credit is claimed on lines 5 or 6.

Date of Birth

Date of Birth

Child’s Name

SSN

Child’s Name

SSN

(MM/DD/YY)

(MM/DD/YY)

Part II—Other Refundable Credits

8.

Authorized Instream Flow Credit

8

0 0

Pass-through Entity Name

Ownership %

Entity Account Number

9. Refundable Credits, add lines 5 (or 6) plus 8. Enter on line 32 of Form 104

9

0 0

1

1 2

2 3

3