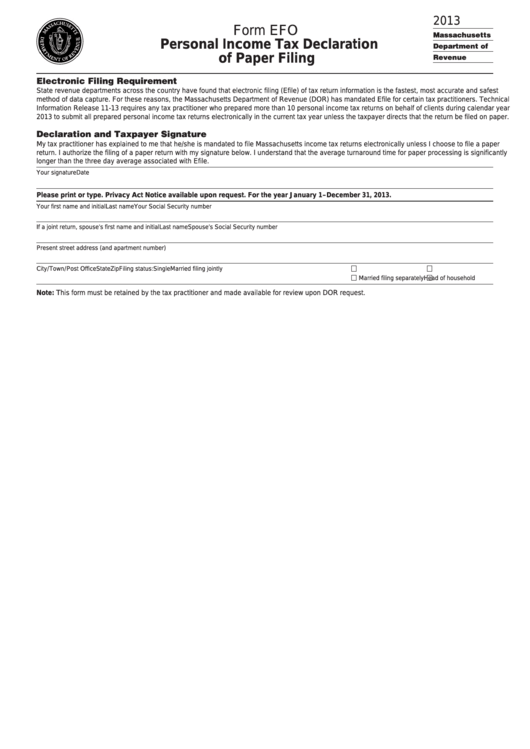

Form Efo - Personal Income Tax Declaration Of Paper Filing - 2013

ADVERTISEMENT

2013

Form EFO

Massachusetts

Personal Income Tax Declaration

epartment of

of Paper Filing

Revenue

Electronic Filing Requirement

State revenue departments across the country have found that electronic filing (Efile) of tax return information is the fastest, most accurate and safest

method of data capture. For these reasons, the Massachusetts Department of Revenue (DOR) has mandated Efile for certain tax practitioners. Technical

Information Release 11-13 requires any tax practitioner who prepared more than 10 personal income tax returns on behalf of clients during calendar year

2013 to submit all prepared personal income tax returns electronically in the current tax year unless the taxpayer directs that the return be filed on paper.

eclaration and Taxpayer Signature

My tax practitioner has explained to me that he/she is mandated to file Massachusetts income tax returns electronically unless I choose to file a paper

return. I authorize the filing of a paper return with my signature below. I understand that the average turnaround time for paper processing is significantly

longer than the three day average associated with Efile.

Your signature

Date

Please print or type. Privacy Act Notice available upon request. For the year January 1– December 31, 2013.

Your first name and initial

Last name

Your Social Security number

If a joint return, spouse’s first name and initial

Last name

Spouse’s Social Security number

Present street address (and apartment number)

City/Town/Post Office

State

Zip

Filing status:

Single

Married filing jointly

Married filing separately

Head of household

Note: This form must be retained by the tax practitioner and made available for review upon DOR request.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1