Instructions For Form E2a - Estate Tax Information And Application For Tax Clearances

ADVERTISEMENT

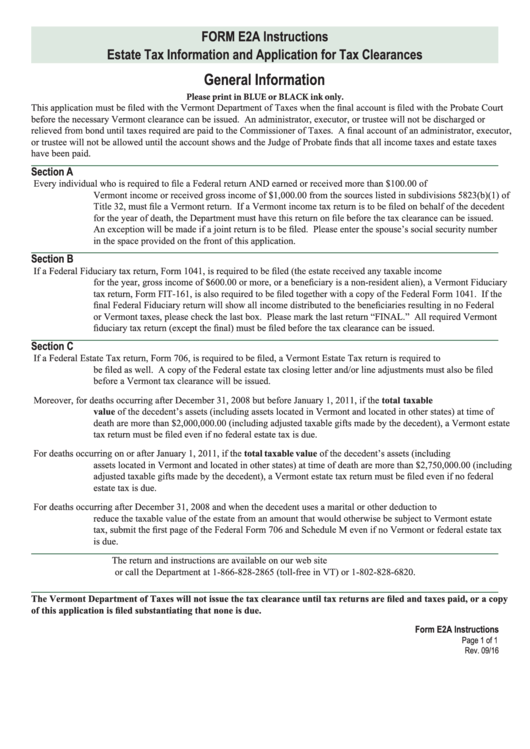

FORM E2A Instructions

Estate Tax Information and Application for Tax Clearances

General Information

Please print in BLUE or BLACK ink only.

This application must be filed with the Vermont Department of Taxes when the final account is filed with the Probate Court

before the necessary Vermont clearance can be issued. An administrator, executor, or trustee will not be discharged or

relieved from bond until taxes required are paid to the Commissioner of Taxes. A final account of an administrator, executor,

or trustee will not be allowed until the account shows and the Judge of Probate finds that all income taxes and estate taxes

have been paid.

Section A

Every individual who is required to file a Federal return AND earned or received more than $100.00 of

Vermont income or received gross income of $1,000.00 from the sources listed in subdivisions 5823(b)(1) of

Title 32, must file a Vermont return. If a Vermont income tax return is to be filed on behalf of the decedent

for the year of death, the Department must have this return on file before the tax clearance can be issued.

An exception will be made if a joint return is to be filed. Please enter the spouse’s social security number

in the space provided on the front of this application.

Section B

If a Federal Fiduciary tax return, Form 1041, is required to be filed (the estate received any taxable income

for the year, gross income of $600.00 or more, or a beneficiary is a non-resident alien), a Vermont Fiduciary

tax return, Form FIT-161, is also required to be filed together with a copy of the Federal Form 1041. If the

final Federal Fiduciary return will show all income distributed to the beneficiaries resulting in no Federal

or Vermont taxes, please check the last box. Please mark the last return “FINAL.” All required Vermont

fiduciary tax return (except the final) must be filed before the tax clearance can be issued.

Section C

If a Federal Estate Tax return, Form 706, is required to be filed, a Vermont Estate Tax return is required to

be filed as well. A copy of the Federal estate tax closing letter and/or line adjustments must also be filed

before a Vermont tax clearance will be issued.

Moreover, for deaths occurring after December 31, 2008 but before January 1, 2011, if the total taxable

value of the decedent’s assets (including assets located in Vermont and located in other states) at time of

death are more than $2,000,000.00 (including adjusted taxable gifts made by the decedent), a Vermont estate

tax return must be filed even if no federal estate tax is due.

For deaths occurring on or after January 1, 2011, if the total taxable value of the decedent’s assets (including

assets located in Vermont and located in other states) at time of death are more than $2,750,000.00 (including

adjusted taxable gifts made by the decedent), a Vermont estate tax return must be filed even if no federal

estate tax is due.

For deaths occurring after December 31, 2008 and when the decedent uses a marital or other deduction to

reduce the taxable value of the estate from an amount that would otherwise be subject to Vermont estate

tax, submit the first page of the Federal Form 706 and Schedule M even if no Vermont or federal estate tax

is due.

The return and instructions are available on our web site

or call the Department at 1-866-828-2865 (toll-free in VT) or 1-802-828-6820.

The Vermont Department of Taxes will not issue the tax clearance until tax returns are filed and taxes paid, or a copy

of this application is filed substantiating that none is due.

Form E2A Instructions

Page 1 of 1

Rev. 09/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1