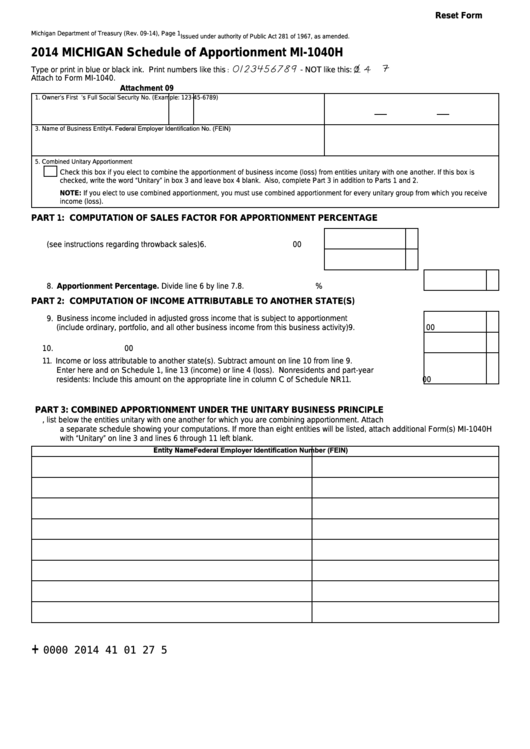

Reset Form

Michigan Department of Treasury (Rev. 09-14), Page 1

Issued under authority of Public Act 281 of 1967, as amended.

2014 MICHIGAN Schedule of Apportionment MI-1040H

1 4

0123456789

Type or print in blue or black ink. Print numbers like this

- NOT like this:

:

Attach to Form MI-1040.

Attachment 09

1. Owner’s First Name

M.I.

Last Name

2. Owner’s Full Social Security No. (Example: 123-45-6789)

4. Federal Employer Identification No. (FEIN)

3. Name of Business Entity

5. Combined Unitary Apportionment

Check this box if you elect to combine the apportionment of business income (loss) from entities unitary with one another. If this box is

checked, write the word “Unitary” in box 3 and leave box 4 blank. Also, complete Part 3 in addition to Parts 1 and 2.

NOTE: If you elect to use combined apportionment, you must use combined apportionment for every unitary group from which you receive

income (loss).

PART 1: COMPUTATION OF SALES FACTOR FOR APPORTIONMENT PERCENTAGE

6. Michigan sales (see instructions regarding throwback sales) .................

6.

00

7. Total sales................................................................................................

7.

00

8. Apportionment Percentage. Divide line 6 by line 7. ............................................................................

8.

%

PART 2: COMPUTATION OF INCOME ATTRIBUTABLE TO ANOTHER STATE(S)

9. Business income included in adjusted gross income that is subject to apportionment

(include ordinary, portfolio, and all other business income from this business activity) .......................... 9.

00

10. Multiply the amount on line 9 by the apportionment percentage on line 8. ............................................ 10.

00

11. Income or loss attributable to another state(s). Subtract amount on line 10 from line 9.

Enter here and on Schedule 1, line 13 (income) or line 4 (loss). Nonresidents and part-year

residents: Include this amount on the appropriate line in column C of Schedule NR ............................. 11.

00

PART 3: COMBINED APPORTIONMENT UNDER THE UNITARY BUSINESS PRINCIPLE

12. If you checked box 5 above, list below the entities unitary with one another for which you are combining apportionment. Attach

a separate schedule showing your computations. If more than eight entities will be listed, attach additional Form(s) MI-1040H

with “Unitary” on line 3 and lines 6 through 11 left blank.

Federal Employer Identification Number (FEIN)

Entity Name

+

0000 2014 41 01 27 5

1

1 2

2