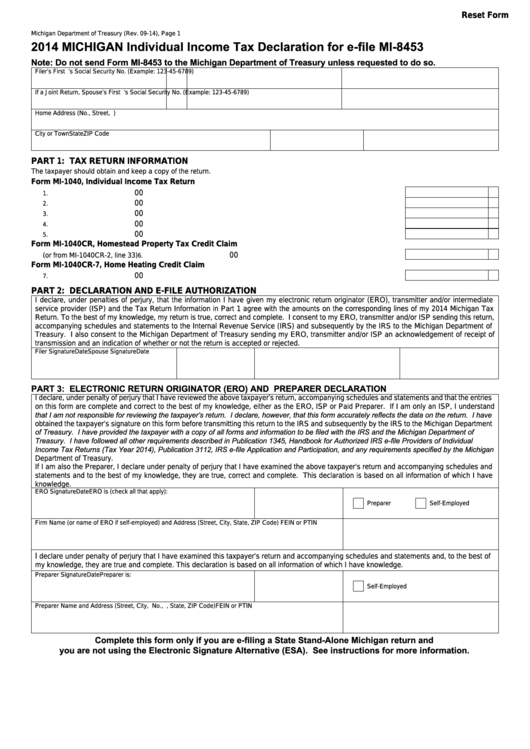

Reset Form

Michigan Department of Treasury (Rev. 09-14), Page 1

2014 MICHIGAN Individual Income Tax Declaration for e-file MI-8453

Note: Do not send Form MI-8453 to the Michigan Department of Treasury unless requested to do so.

Filer’s First Name

M.I.

Last Name

Filer’s Social Security No. (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name

M.I.

Last Name

Spouse’s Social Security No. (Example: 123-45-6789)

Home Address (No., Street, P.O. Box)

City or Town

State

ZIP Code

PART 1: TAX RETURN INFORMATION

The taxpayer should obtain and keep a copy of the return.

Form MI-1040, Individual Income Tax Return

00

1. Total federal adjusted gross income from line 10 ..............................................................................................

1.

00

2. Total Michigan income tax from line 20 .............................................................................................................

2.

00

3. Michigan tax withheld from line 29 ....................................................................................................................

3.

00

4. Tax due from line 32 ..........................................................................................................................................

4.

00

5. Refund from line 35 ...........................................................................................................................................

5.

Form MI-1040CR, Homestead Property Tax Credit Claim

00

6. Homestead Property Tax Credit from line 44 (or from MI-1040CR-2, line 33) ...................................................

6.

Form MI-1040CR-7, Home Heating Credit Claim

00

7. Home Heating Credit from line 44 .....................................................................................................................

7.

PART 2: DECLARATION AND E-FILE AUTHORIZATION

I declare, under penalties of perjury, that the information I have given my electronic return originator (ERO), transmitter and/or intermediate

service provider (ISP) and the Tax Return Information in Part 1 agree with the amounts on the corresponding lines of my 2014 Michigan Tax

Return. To the best of my knowledge, my return is true, correct and complete. I consent to my ERO, transmitter and/or ISP sending this return,

accompanying schedules and statements to the Internal Revenue Service (IRS) and subsequently by the IRS to the Michigan Department of

Treasury. I also consent to the Michigan Department of Treasury sending my ERO, transmitter and/or ISP an acknowledgement of receipt of

transmission and an indication of whether or not the return is accepted or rejected.

Filer Signature

Date

Spouse Signature

Date

PART 3: ELECTRONIC RETURN ORIGINATOR (ERO) AND PREPARER DECLARATION

I declare, under penalty of perjury that I have reviewed the above taxpayer’s return, accompanying schedules and statements and that the entries

on this form are complete and correct to the best of my knowledge, either as the ERO, ISP or Paid Preparer. If I am only an ISP, I understand

that I am not responsible for reviewing the taxpayer’s return. I declare, however, that this form accurately reflects the data on the return. I have

obtained the taxpayer’s signature on this form before transmitting this return to the IRS and subsequently by the IRS to the Michigan Department

of Treasury. I have provided the taxpayer with a copy of all forms and information to be filed with the IRS and the Michigan Department of

Treasury. I have followed all other requirements described in Publication 1345, Handbook for Authorized IRS e-file Providers of Individual

Income Tax Returns (Tax Year 2014), Publication 3112, IRS e-file Application and Participation, and any requirements specified by the Michigan

Department of Treasury.

If I am also the Preparer, I declare under penalty of perjury that I have examined the above taxpayer’s return and accompanying schedules and

statements and to the best of my knowledge, they are true, correct and complete. This declaration is based on all information of which I have

knowledge.

ERO Signature

Date

ERO is (check all that apply):

Preparer

Self-Employed

Firm Name (or name of ERO if self-employed) and Address (Street, City, State, ZIP Code)

FEIN or PTIN

I

declare under penalty of perjury that I have examined this taxpayer’s return and accompanying schedules and statements and, to the best of

my knowledge, they are true and complete. This declaration is based on all information of which I have knowledge.

Preparer Signature

Date

Preparer is:

Self-Employed

Preparer Name and Address (Street, City, No., P.O. Box, State, ZIP Code)

FEIN or PTIN

Complete this form only if you are e-filing a State Stand-Alone Michigan return and

you are not using the Electronic Signature Alternative (ESA). See instructions for more information.

1

1 2

2