Instructions For Schedule In-112 - Vermont Tax Adjustments And Credits - 2017

ADVERTISEMENT

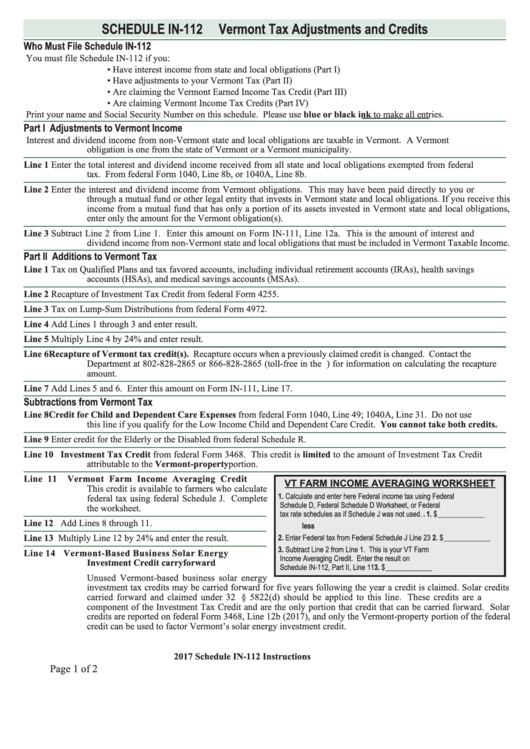

SCHEDULE IN-112

Vermont Tax Adjustments and Credits

Who Must File Schedule IN-112

You must file Schedule IN-112 if you:

• Have interest income from state and local obligations (Part I)

• Have adjustments to your Vermont Tax (Part II)

• Are claiming the Vermont Earned Income Tax Credit (Part III)

• Are claiming Vermont Income Tax Credits (Part IV)

Print your name and Social Security Number on this schedule. Please use blue or black ink to make all entries.

Part I Adjustments to Vermont Income

Interest and dividend income from non-Vermont state and local obligations are taxable in Vermont. A Vermont

obligation is one from the state of Vermont or a Vermont municipality.

Line 1

Enter the total interest and dividend income received from all state and local obligations exempted from federal

tax. From federal Form 1040, Line 8b, or 1040A, Line 8b.

Line 2

Enter the interest and dividend income from Vermont obligations. This may have been paid directly to you or

through a mutual fund or other legal entity that invests in Vermont state and local obligations. If you receive this

income from a mutual fund that has only a portion of its assets invested in Vermont state and local obligations,

enter only the amount for the Vermont obligation(s).

Line 3

Subtract Line 2 from Line 1. Enter this amount on Form IN-111, Line 12a. This is the amount of interest and

dividend income from non-Vermont state and local obligations that must be included in Vermont Taxable Income.

Part II Additions to Vermont Tax

Line 1

Tax on Qualified Plans and tax favored accounts, including individual retirement accounts (IRAs), health savings

accounts (HSAs), and medical savings accounts (MSAs).

Line 2

Recapture of Investment Tax Credit from federal Form 4255.

Line 3

Tax on Lump-Sum Distributions from federal Form 4972.

Line 4

Add Lines 1 through 3 and enter result.

Line 5

Multiply Line 4 by 24% and enter result.

Line 6

Recapture of Vermont tax credit(s). Recapture occurs when a previously claimed credit is changed. Contact the

Department at 802-828-2865 or 866-828-2865 (toll-free in the U.S.) for information on calculating the recapture

amount.

Line 7

Add Lines 5 and 6. Enter this amount on Form IN-111, Line 17.

Subtractions from Vermont Tax

Line 8

Credit for Child and Dependent Care Expenses from federal Form 1040, Line 49; 1040A, Line 31. Do not use

this line if you qualify for the Low Income Child and Dependent Care Credit. You cannot take both credits.

Line 9

Enter credit for the Elderly or the Disabled from federal Schedule R.

Line 10

Investment Tax Credit from federal Form 3468. This credit is limited to the amount of Investment Tax Credit

attributable to the Vermont-property portion.

Line 11

Vermont Farm Income Averaging Credit

VT FARM INCOME AVERAGING WORKSHEET

This credit is available to farmers who calculate

1. Calculate and enter here Federal income tax using Federal

federal tax using federal Schedule J. Complete

Schedule D, Federal Schedule D Worksheet, or Federal

the worksheet.

tax rate schedules as if Schedule J was not used. . 1. $ _____________

Line 12

Add Lines 8 through 11.

less

Line 13

Multiply Line 12 by 24% and enter the result.

2. Enter Federal tax from Federal Schedule J Line 23 2. $ _____________

3. Subtract Line 2 from Line 1. This is your VT Farm

Line 14

Vermont-Based Business Solar Energy

Income Averaging Credit. Enter the result on

Investment Credit carryforward

Schedule IN-112, Part II, Line 11 . . . . . . . . . . . . . . 3. $ _____________

Unused Vermont-based business solar energy

investment tax credits may be carried forward for five years following the year a credit is claimed. Solar credits

carried forward and claimed under 32 V.S.A. § 5822(d) should be applied to this line. These credits are a

component of the Investment Tax Credit and are the only portion that credit that can be carried forward. Solar

credits are reported on federal Form 3468, Line 12b (2017), and only the Vermont-property portion of the federal

credit can be used to factor Vermont’s solar energy investment credit.

2017 Schedule IN-112 Instructions

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2