Instructions For Schedule In-155 - Federal Itemized Deductions Addback - 2017

ADVERTISEMENT

SCHEDULE IN-155

Federal Itemized Deductions Addback

Who must file Schedule IN-155?

If you itemized your deductions on your 2017 federal Form 1040, Line 40

Do not file this form if you used the federal standard deduction.

The amount of state and local income taxes from federal adjusted gross income for the taxable year is required to be

added back to Vermont Taxable Income. However, the amount is limited to that which will reduce total itemized

deductions below the standard deduction.

PART A 2017 State and Local Income Tax Addback

Line 1

Enter amount of itemized deductions from federal Form 1040, Schedule A, Line 29.

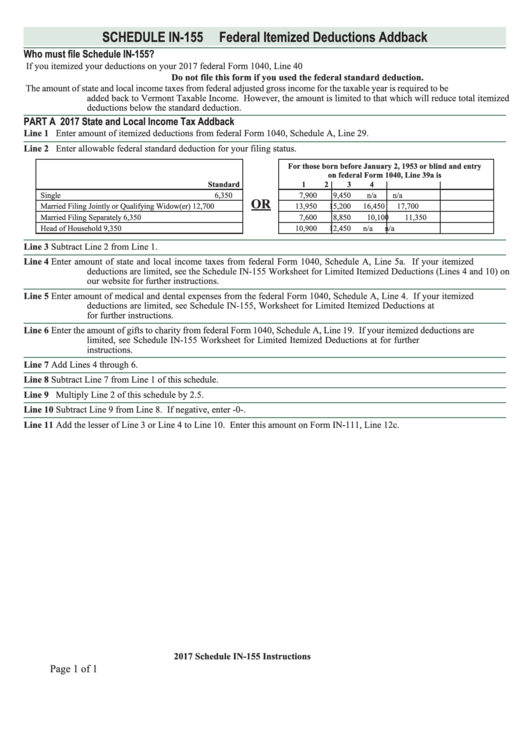

Line 2

Enter allowable federal standard deduction for your filing status.

For those born before January 2, 1953 or blind and entry

on federal Form 1040, Line 39a is

Standard

1

2

3

4

Single

6,350

7,900

9,450

n/a

n/a

OR

Married Filing Jointly or Qualifying Widow(er)

12,700

13,950

15,200

16,450

17,700

Married Filing Separately

6,350

7,600

8,850

10,100

11,350

Head of Household

9,350

10,900

12,450

n/a

n/a

Line 3

Subtract Line 2 from Line 1.

Line 4

Enter amount of state and local income taxes from federal Form 1040, Schedule A, Line 5a. If your itemized

deductions are limited, see the Schedule IN-155 Worksheet for Limited Itemized Deductions (Lines 4 and 10) on

our website for further instructions.

Line 5

Enter amount of medical and dental expenses from the federal Form 1040, Schedule A, Line 4. If your itemized

deductions are limited, see Schedule IN-155, Worksheet for Limited Itemized Deductions at

for further instructions.

Line 6

Enter the amount of gifts to charity from federal Form 1040, Schedule A, Line 19. If your itemized deductions are

limited, see Schedule IN-155 Worksheet for Limited Itemized Deductions at for further

instructions.

Line 7

Add Lines 4 through 6.

Line 8

Subtract Line 7 from Line 1 of this schedule.

Line 9

Multiply Line 2 of this schedule by 2.5.

Line 10

Subtract Line 9 from Line 8. If negative, enter -0-.

Line 11

Add the lesser of Line 3 or Line 4 to Line 10. Enter this amount on Form IN-111, Line 12c.

2017 Schedule IN-155 Instructions

Page 1 of 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1