2

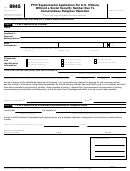

Form 8946 (Rev. 10-2015)

Page

General Instructions

How To Apply

Online. Go to webpage for information. During the

Section references are to the Internal Revenue Code unless otherwise

PTIN application process, you will be prompted to complete and mail

noted.

Form 8946 and supporting documents to the address noted below.

Future Developments

Applying by mail. Complete both Form W-12 and Form 8946. Payment

of the application processing fee must accompany this form or it will be

For the latest information about developments related to Form 8946 and

rejected. The PTIN registration fee for the 2016 calendar year is $50.00.

its instructions, such as legislation enacted after they were published,

go to

• If you are registering for a 2015 PTIN and/or prior calendar year PTIN,

the application processing fee for each calendar year is $64.25.

Purpose of Form

• PTIN fees are nonrefundable.

Form 8946 is used by foreign persons without a social security number

• A separate PTIN fee (payment) must be submitted for each calendar

(SSN) who want to prepare tax returns for compensation. Foreign

year a PTIN is requested. See Form W-12 instructions for requesting

persons who are tax return preparers must obtain a preparer tax

prior-year PTINs.

identification number (PTIN) to be eligible to prepare tax returns for

compensation. Generally, the IRS requires an individual to provide an

• Make checks or money orders payable to “IRS Tax Pro PTIN Fee.”

SSN to get a PTIN. Because foreign persons generally cannot get an

• Do not paper clip, staple, or otherwise attach the payment to Form

SSN, they must file Form 8946 to establish their identity and status as a

W-12.

foreign person.

• Send both forms, the payment for the application processing fee, and

You must have a PTIN to be eligible to prepare a tax return

the supporting documents to the following address.

for compensation.

TIP

IRS Tax Pro PTIN Processing Center

104 Brookeridge Drive #5000

Waterloo, IA 50702

SSNs. Do not complete Form 8946 if:

Allow 4 to 6 weeks for the IRS to process your application.

• You have an SSN,

Submission of Form 8946. Submit the following.

• You are eligible to get an SSN,

1. Your completed Form 8946.

• You are a U.S. citizen, or

2. The original documents or certified copies of documents that verify

• You have been admitted by the United States for permanent residence

the information provided on Form 8946. If you are sending copies

or U.S. employment.

of documents, see the information below. The supporting

documentation must be consistent with the information provided on

To get an SSN, see Form SS-5, Application for a Social Security Card.

Form 8946. For example, the name must be the same as on Form

To get Form SS-5 or to find out if you are eligible to get an SSN, go to

8946, line 1 (or in the case of a civil birth certificate, line 3), and the

or contact a Social Security Administration

date of birth must be the same as on Form 8946, line 3.

(SSA) office.

To avoid any loss of your documents, it is suggested you do

If you have an application for an SSN pending, do not file Form 8946.

not submit the original documentation.

Complete Form 8946 only if the SSA notifies you that an SSN cannot be

TIP

issued.

If you already have an SSN, enter the SSN when you apply for your

You can submit original documents or certified copies. A certified

PTIN using Form W-12, IRS Paid Preparer Tax Identification Number

document is one that the original issuing agency provides and certifies

(PTIN) Application and Renewal.

as an exact copy of the original document and contains an official seal

Telephone help. If you have questions about completing this form, the

from the issuing agency. All certifications must stay attached to the

status of your application, or the return of your original documents

copies of the documents when they're sent to the IRS. Certified

submitted with this form, you may call the following phone numbers. If

documents have a stamp and/or an ink seal (may or may not be raised).

calling from the United States, call 1-877-613-PTIN (7846). For TTY/TDD

Any document certified by a foreign official must be issued by the

assistance, call 1-877-613-3686. If calling internationally, call

agency or official custodian of the original record. The foreign

+1 915-342-5655 (not a toll-free number). Telephone help is generally

certification must clearly certify that each document is a true copy of the

available Monday through Friday from 8:00 a.m. through 5:00 p.m.

original. All certifications must stay attached to the copies of the

Central time.

documents when they are sent to the IRS.

Who Must Apply

Original documents you submit will be returned to you at

the mailing address shown on your Form 8946. You do not

TIP

As part of applying for a PTIN, a foreign person must file Form 8946 to

need to provide a return envelope. If your original

establish their identity and status as a foreign person. A foreign person

documents are not returned within 60 days, you can call the

is an individual who does not have and is not eligible to obtain an SSN

phone numbers provided earlier under Telephone help. Copies of

and is neither a citizen of the United States nor a resident alien of the

documents will not be returned.

United States as defined in section 7701(b)(1)(A).

If you submit an original valid passport (or a certified copy of a

For the purposes of receiving a PTIN, the United States includes any

valid passport), you do not need to submit any other documents.

state, territory, or possession of the United States, including a

Otherwise, you must submit two current documents that, when the

commonwealth, or the District of Columbia.

combined information on the documents is taken into account, verify

Only preparers who have a foreign (non-U.S.) address may

▲

your identity and your status as a foreign person. At least one document

!

file this form. If you do not have a foreign address, do not

must contain your photograph. The documents must be government

file this form. See How To Apply, later, for more information

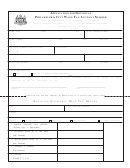

issued. Examples of acceptable supporting documents are listed in the

about submitting documents with this form.

CAUTION

following table. If you submit copies of documents that display

information on both sides, copies of both the front and back must be

attached to the Form 8946. Do not attach expired documents.

1

1 2

2 3

3