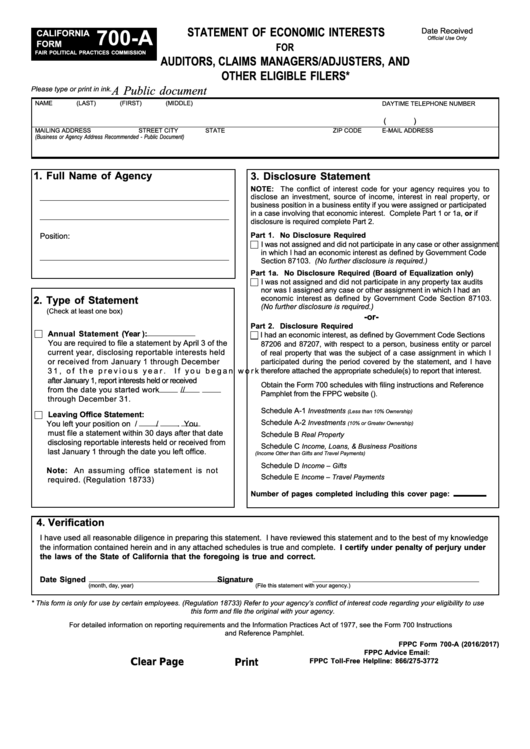

Statement of economic intereStS

700-A

date received

CAliForNiA

Official Use Only

Form

for

FAir PolitiCAl PrACtiCeS CommiSSioN

auditorS, claimS managerS/adjuSterS, and

other eligible filerS*

A Public document

Please type or print in ink.

Name

(Last)

(First)

(middLe)

dayTime TelePhone number

(

)

mailinG addreSS

STreeT

CiTy

STaTe

ziP Code

e-mail addreSS

(Business or Agency Address Recommended - Public Document)

1. Full Name of Agency

3. Disclosure Statement

Note: The conflict of interest code for your agency requires you to

disclose an investment, source of income, interest in real property, or

business position in a business entity if you were assigned or participated

in a case involving that economic interest. Complete Part 1 or 1a, or if

disclosure is required complete Part 2.

Part 1. No Disclosure required

Position:

i was not assigned and did not participate in any case or other assignment

in which i had an economic interest as defined by Government Code

Section 87103. (No further disclosure is required.)

Part 1a. No Disclosure required (Board of equalization only)

i was not assigned and did not participate in any property tax audits

nor was i assigned any case or other assignment in which i had an

2. type of Statement

economic interest as defined by Government Code Section 87103.

(No further disclosure is required.)

(Check at least one box)

-or-

Part 2. Disclosure required

Annual Statement (Year

):

i had an economic interest, as defined by Government Code Sections

you are required to file a statement by april 3 of the

87206 and 87207, with respect to a person, business entity or parcel

current year, disclosing reportable interests held

of real property that was the subject of a case assignment in which i

or received from January 1 through december

participated during the period covered by the statement, and i have

31, of the previous year. if you began work

therefore attached the appropriate schedule(s) to report that interest.

after January 1, report interests held or received

obtain the Form 700 schedules with filing instructions and reference

from the date you started work

/

/

Pamphlet from the FPPC website ( ).

through december 31.

Schedule a-1

Investments

(Less than 10% Ownership)

Leaving Office Statement:

Schedule a-2

you left your position on

/

/

. you

Investments

(10% or Greater Ownership)

must file a statement within 30 days after that date

Schedule b

Real Property

disclosing reportable interests held or received from

Schedule C

Income, Loans, & Business Positions

last January 1 through the date you left office.

(Income Other than Gifts and Travel Payments)

Schedule d

Income – Gifts

Note: an assuming office statement is not

Schedule e

Income – Travel Payments

required. (regulation 18733)

Number of pages completed including this cover page:

4. Verification

i have used all reasonable diligence in preparing this statement. i have reviewed this statement and to the best of my knowledge

the information contained herein and in any attached schedules is true and complete. i certify under penalty of perjury under

the laws of the State of California that the foregoing is true and correct.

Date Signed

Signature

(month, day, year)

(File this statement with your agency.)

* This form is only for use by certain employees. (Regulation 18733) Refer to your agency’s conflict of interest code regarding your eligibility to use

this form and file the original with your agency.

For detailed information on reporting requirements and the information Practices act of 1977, see the Form 700 instructions

and reference Pamphlet.

FPPC Form 700-A (2016/2017)

FPPC Advice email: advice@fppc.ca.gov

FPPC toll-Free Helpline: 866/275-3772

Clear Page

Print

1

1