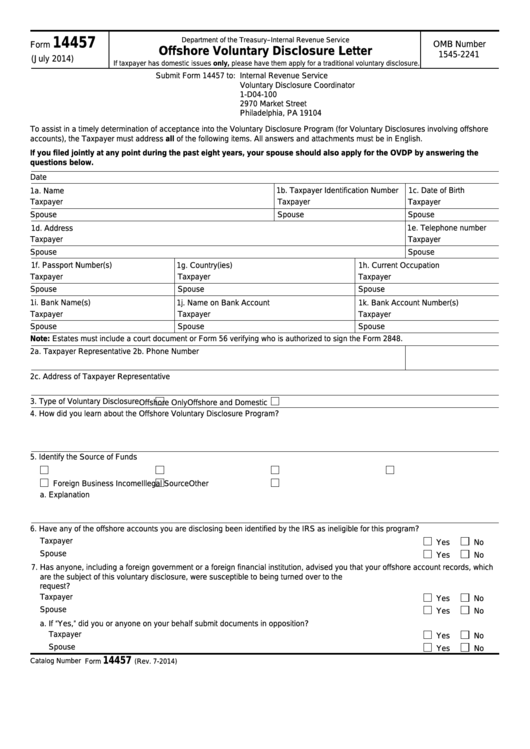

Department of the Treasury–Internal Revenue Service

14457

OMB Number

Form

Offshore Voluntary Disclosure Letter

1545-2241

(July 2014)

If taxpayer has domestic issues only, please have them apply for a traditional voluntary disclosure.

Submit Form 14457 to: Internal Revenue Service

Voluntary Disclosure Coordinator

1-D04-100

2970 Market Street

Philadelphia, PA 19104

To assist in a timely determination of acceptance into the Voluntary Disclosure Program (for Voluntary Disclosures involving offshore

accounts), the Taxpayer must address all of the following items. All answers and attachments must be in English.

If you filed jointly at any point during the past eight years, your spouse should also apply for the OVDP by answering the

questions below.

Date

1a. Name

1b. Taxpayer Identification Number

1c. Date of Birth

Taxpayer

Taxpayer

Taxpayer

Spouse

Spouse

Spouse

1d. Address

1e. Telephone number

Taxpayer

Taxpayer

Spouse

Spouse

1f. Passport Number(s)

1g. Country(ies)

1h. Current Occupation

Taxpayer

Taxpayer

Taxpayer

Spouse

Spouse

Spouse

1i. Bank Name(s)

1j. Name on Bank Account

1k. Bank Account Number(s)

Taxpayer

Taxpayer

Taxpayer

Spouse

Spouse

Spouse

Note: Estates must include a court document or Form 56 verifying who is authorized to sign the Form 2848.

2a. Taxpayer Representative

2b. Phone Number

2c. Address of Taxpayer Representative

3. Type of Voluntary Disclosure

Offshore Only

Offshore and Domestic

4. How did you learn about the Offshore Voluntary Disclosure Program?

5. Identify the Source of Funds

U.S. Wages

U.S. Business Income

Gift/Inheritance

Foreign Wages

Foreign Business Income

Illegal Source

Other

a. Explanation

6. Have any of the offshore accounts you are disclosing been identified by the IRS as ineligible for this program?

Taxpayer

Yes

No

Spouse

Yes

No

7. Has anyone, including a foreign government or a foreign financial institution, advised you that your offshore account records, which

are the subject of this voluntary disclosure, were susceptible to being turned over to the U.S. Government pursuant to an official

request?

Taxpayer

Yes

No

Spouse

Yes

No

a. If “Yes,” did you or anyone on your behalf submit documents in opposition?

Taxpayer

Yes

No

Spouse

Yes

No

14457

Catalog Number 61637F

Form

(Rev. 7-2014)

1

1 2

2 3

3