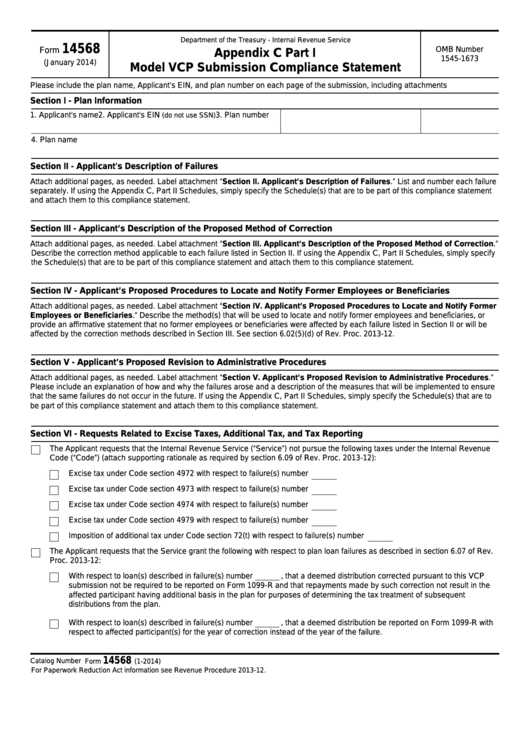

Department of the Treasury - Internal Revenue Service

14568

OMB Number

Form

Appendix C Part I

1545-1673

(January 2014)

Model VCP Submission Compliance Statement

Please include the plan name, Applicant’s EIN, and plan number on each page of the submission, including attachments

Section I - Plan Information

1. Applicant's name

2. Applicant's EIN

3. Plan number

(do not use SSN)

4. Plan name

Section II - Applicant's Description of Failures

Attach additional pages, as needed. Label attachment “Section II. Applicant’s Description of Failures.” List and number each failure

separately. If using the Appendix C, Part II Schedules, simply specify the Schedule(s) that are to be part of this compliance statement

and attach them to this compliance statement.

Section III - Applicant’s Description of the Proposed Method of Correction

Attach additional pages, as needed. Label attachment “Section III. Applicant’s Description of the Proposed Method of Correction.”

Describe the correction method applicable to each failure listed in Section II. If using the Appendix C, Part II Schedules, simply specify

the Schedule(s) that are to be part of this compliance statement and attach them to this compliance statement.

Section IV - Applicant’s Proposed Procedures to Locate and Notify Former Employees or Beneficiaries

Attach additional pages, as needed. Label attachment “Section IV. Applicant’s Proposed Procedures to Locate and Notify Former

Employees or Beneficiaries.” Describe the method(s) that will be used to locate and notify former employees and beneficiaries, or

provide an affirmative statement that no former employees or beneficiaries were affected by each failure listed in Section II or will be

affected by the correction methods described in Section III. See section 6.02(5)(d) of Rev. Proc. 2013-12.

Section V - Applicant’s Proposed Revision to Administrative Procedures

Attach additional pages, as needed. Label attachment “Section V. Applicant’s Proposed Revision to Administrative Procedures.”

Please include an explanation of how and why the failures arose and a description of the measures that will be implemented to ensure

that the same failures do not occur in the future. If using the Appendix C, Part II Schedules, simply specify the Schedule(s) that are to

be part of this compliance statement and attach them to this compliance statement.

Section VI - Requests Related to Excise Taxes, Additional Tax, and Tax Reporting

The Applicant requests that the Internal Revenue Service (“Service”) not pursue the following taxes under the Internal Revenue

Code (“Code”) (attach supporting rationale as required by section 6.09 of Rev. Proc. 2013-12):

Excise tax under Code section 4972 with respect to failure(s) number

Excise tax under Code section 4973 with respect to failure(s) number

Excise tax under Code section 4974 with respect to failure(s) number

Excise tax under Code section 4979 with respect to failure(s) number

Imposition of additional tax under Code section 72(t) with respect to failure(s) number

The Applicant requests that the Service grant the following with respect to plan loan failures as described in section 6.07 of Rev.

Proc. 2013-12:

With respect to loan(s) described in failure(s) number

, that a deemed distribution corrected pursuant to this VCP

submission not be required to be reported on Form 1099-R and that repayments made by such correction not result in the

affected participant having additional basis in the plan for purposes of determining the tax treatment of subsequent

distributions from the plan.

With respect to loan(s) described in failure(s) number

, that a deemed distribution be reported on Form 1099-R with

respect to affected participant(s) for the year of correction instead of the year of the failure.

14568

Catalog Number 66138J

Form

(1-2014)

For Paperwork Reduction Act information see Revenue Procedure 2013-12.

1

1 2

2 3

3