Form Ap-220 - Instructions For Completing Texas Sales And Use Tax Permit Application

ADVERTISEMENT

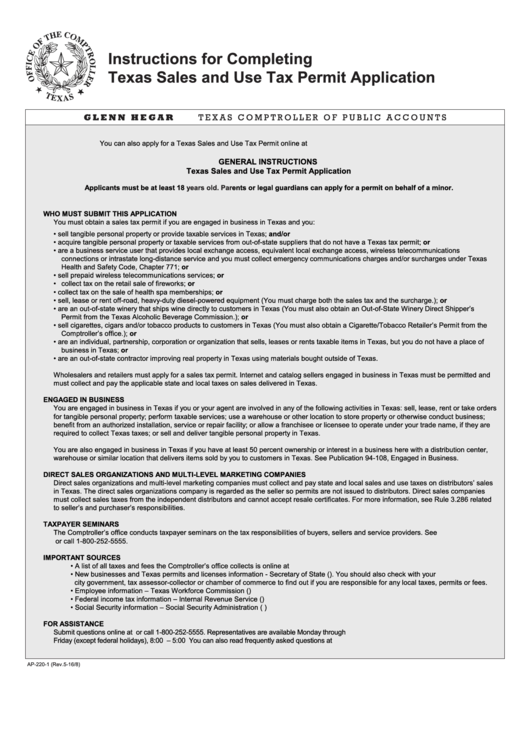

Instructions for Completing

Texas Sales and Use Tax Permit Application

G L E N N H E G A R

T E X A S C O M P T R O L L E R O F P U B L I C A C C O U N T S

You can also apply for a Texas Sales and Use Tax Permit online at

GENERAL INSTRUCTIONS

Texas Sales and Use Tax Permit Application

Applicants must be at least 18

years old.

Parents or legal guardians can apply for a permit on behalf of a minor.

WHO MUST SUBMIT THIS APPLICATION

You must obtain a sales tax permit if you are engaged in business in Texas and you:

• sell tangible personal property or provide taxable services in Texas; and/or

• acquire tangible personal property or taxable services from out-of-state suppliers that do not have a Texas tax permit; or

• are a business service user that provides local exchange access, equivalent local exchange access, wireless telecommunications

connections or intrastate long-distance service and you must collect emergency communications charges and/or surcharges under Texas

Health and Safety Code, Chapter 771; or

• sell prepaid wireless telecommunications services; or

• collect tax on the retail sale of fireworks; or

• collect tax on the sale of health spa memberships; or

• sell, lease or rent off-road, heavy-duty diesel-powered equipment (You must charge both the sales tax and the surcharge.); or

• are an out-of-state winery that ships wine directly to customers in Texas (You must also obtain an Out-of-State Winery Direct Shipper’s

Permit from the Texas Alcoholic Beverage Commission.); or

• sell cigarettes, cigars and/or tobacco products to customers in Texas (You must also obtain a Cigarette/Tobacco Retailer’s Permit from the

Comptroller’s office.); or

• are an individual, partnership, corporation or organization that sells, leases or rents taxable items in Texas, but you do not have a place of

business in Texas; or

• are an out-of-state contractor improving real property in Texas using materials bought outside of Texas.

Wholesalers and retailers must apply for a sales tax permit. Internet and catalog sellers engaged in business in Texas must be permitted and

must collect and pay the applicable state and local taxes on sales delivered in Texas.

ENGAGED IN BUSINESS

You are engaged in business in Texas if you or your agent are involved in any of the following activities in Texas: sell, lease, rent or take orders

for tangible personal property; perform taxable services; use a warehouse or other location to store property or otherwise conduct business;

benefit from an authorized installation, service or repair facility; or allow a franchisee or licensee to operate under your trade name, if they are

required to collect Texas taxes; or sell and deliver tangible personal property in Texas.

You are also engaged in business in Texas if you have at least 50 percent ownership or interest in a business here with a distribution center,

warehouse or similar location that delivers items sold by you to customers in Texas. See Publication 94-108, Engaged in Business.

DIRECT SALES ORGANIZATIONS AND MULTI-LEVEL MARKETING COMPANIES

Direct sales organizations and multi-level marketing companies must collect and pay state and local sales and use taxes on distributors’ sales

in Texas. The direct sales organizations company is regarded as the seller so permits are not issued to distributors. Direct sales companies

must collect sales taxes from the independent distributors and cannot accept resale certificates. For more information, see Rule 3.286 related

to seller’s and purchaser’s responsibilities.

TAXPAYER SEMINARS

The Comptroller’s office conducts taxpayer seminars on the tax responsibilities of buyers, sellers and service providers. See

or call 1-800-252-5555.

IMPORTANT SOURCES

• A list of all taxes and fees the Comptroller’s office collects is online at

• New businesses and Texas permits and licenses information - Secretary of State ( ). You should also check with your

city government, tax assessor-collector or chamber of commerce to find out if you are responsible for any local taxes, permits or fees.

• Employee information – Texas Workforce Commission ( )

• Federal income tax information – Internal Revenue Service ( )

• Social Security information – Social Security Administration ( )

FOR ASSISTANCE

Submit questions online at or call 1-800-252-5555. Representatives are available Monday through

Friday (except federal holidays), 8:00 a.m. – 5:00 p.m. You can also read frequently asked questions at

AP-220-1 (Rev.5-16/8)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4