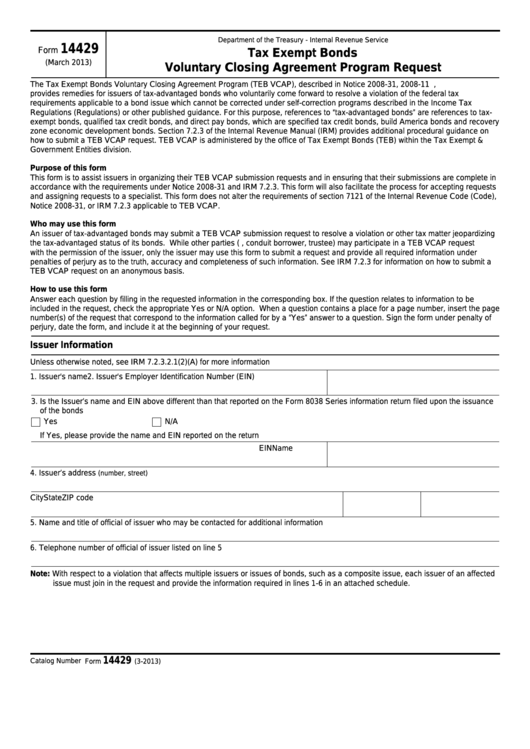

Department of the Treasury - Internal Revenue Service

14429

Form

Tax Exempt Bonds

(March 2013)

Voluntary Closing Agreement Program Request

The Tax Exempt Bonds Voluntary Closing Agreement Program (TEB VCAP), described in Notice 2008-31, 2008-11 I.R.B. 592,

provides remedies for issuers of tax-advantaged bonds who voluntarily come forward to resolve a violation of the federal tax

requirements applicable to a bond issue which cannot be corrected under self-correction programs described in the Income Tax

Regulations (Regulations) or other published guidance. For this purpose, references to “tax-advantaged bonds” are references to tax-

exempt bonds, qualified tax credit bonds, and direct pay bonds, which are specified tax credit bonds, build America bonds and recovery

zone economic development bonds. Section 7.2.3 of the Internal Revenue Manual (IRM) provides additional procedural guidance on

how to submit a TEB VCAP request. TEB VCAP is administered by the office of Tax Exempt Bonds (TEB) within the Tax Exempt &

Government Entities division.

Purpose of this form

This form is to assist issuers in organizing their TEB VCAP submission requests and in ensuring that their submissions are complete in

accordance with the requirements under Notice 2008-31 and IRM 7.2.3. This form will also facilitate the process for accepting requests

and assigning requests to a specialist. This form does not alter the requirements of section 7121 of the Internal Revenue Code (Code),

Notice 2008-31, or IRM 7.2.3 applicable to TEB VCAP.

Who may use this form

An issuer of tax-advantaged bonds may submit a TEB VCAP submission request to resolve a violation or other tax matter jeopardizing

the tax-advantaged status of its bonds. While other parties (e.g., conduit borrower, trustee) may participate in a TEB VCAP request

with the permission of the issuer, only the issuer may use this form to submit a request and provide all required information under

penalties of perjury as to the truth, accuracy and completeness of such information. See IRM 7.2.3 for information on how to submit a

TEB VCAP request on an anonymous basis.

How to use this form

Answer each question by filling in the requested information in the corresponding box. If the question relates to information to be

included in the request, check the appropriate Yes or N/A option. When a question contains a place for a page number, insert the page

number(s) of the request that correspond to the information called for by a “Yes” answer to a question. Sign the form under penalty of

perjury, date the form, and include it at the beginning of your request.

Issuer Information

Unless otherwise noted, see IRM 7.2.3.2.1(2)(A) for more information

1. Issuer's name

2. Issuer's Employer Identification Number (EIN)

3. Is the Issuer’s name and EIN above different than that reported on the Form 8038 Series information return filed upon the issuance

of the bonds

Yes

N/A

If Yes, please provide the name and EIN reported on the return

Name

EIN

4. Issuer’s address

(number, street)

City

State

ZIP code

5. Name and title of official of issuer who may be contacted for additional information

6. Telephone number of official of issuer listed on line 5

Note: With respect to a violation that affects multiple issuers or issues of bonds, such as a composite issue, each issuer of an affected

issue must join in the request and provide the information required in lines 1-6 in an attached schedule.

14429

Catalog Number 60719A

Form

(3-2013)

1

1 2

2 3

3 4

4 5

5