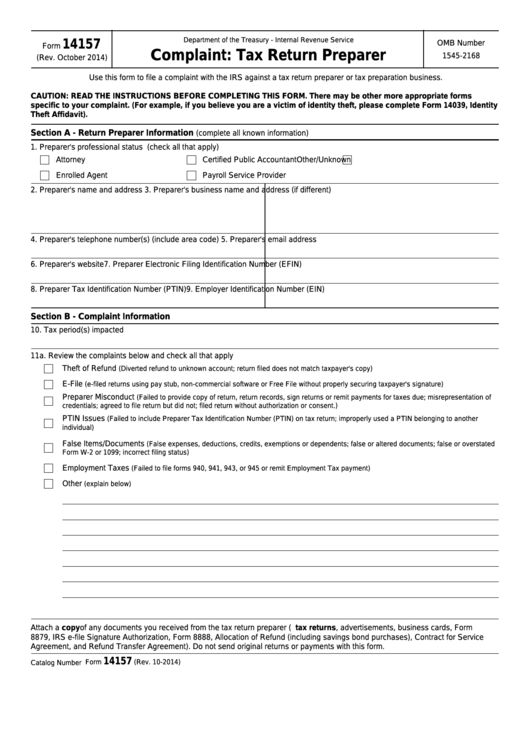

Department of the Treasury - Internal Revenue Service

14157

OMB Number

Form

Complaint: Tax Return Preparer

1545-2168

(Rev. October 2014)

Use this form to file a complaint with the IRS against a tax return preparer or tax preparation business.

CAUTION: READ THE INSTRUCTIONS BEFORE COMPLETING THIS FORM. There may be other more appropriate forms

specific to your complaint. (For example, if you believe you are a victim of identity theft, please complete Form 14039, Identity

Theft Affidavit).

Section A - Return Preparer Information

(complete all known information)

1. Preparer's professional status (check all that apply)

Attorney

Certified Public Accountant

Other/Unknown

Enrolled Agent

Payroll Service Provider

2. Preparer's name and address

3. Preparer's business name and address (if different)

5. Preparer's email address

4. Preparer's telephone number(s) (include area code)

6. Preparer's website

7. Preparer Electronic Filing Identification Number (EFIN)

8. Preparer Tax Identification Number (PTIN)

9. Employer Identification Number (EIN)

Section B - Complaint Information

10. Tax period(s) impacted

11a. Review the complaints below and check all that apply

Theft of Refund

(Diverted refund to unknown account; return filed does not match taxpayer's copy)

E-File

(e-filed returns using pay stub, non-commercial software or Free File without properly securing taxpayer's signature)

Preparer Misconduct

(Failed to provide copy of return, return records, sign returns or remit payments for taxes due; misrepresentation of

credentials; agreed to file return but did not; filed return without authorization or consent.)

PTIN Issues

(Failed to include Preparer Tax Identification Number (PTIN) on tax return; improperly used a PTIN belonging to another

individual)

False Items/Documents

(False expenses, deductions, credits, exemptions or dependents; false or altered documents; false or overstated

Form W-2 or 1099; incorrect filing status)

Employment Taxes

(Failed to file forms 940, 941, 943, or 945 or remit Employment Tax payment)

Other

(explain below)

Attach a copy of any documents you received from the tax return preparer (e.g. tax returns, advertisements, business cards, Form

8879, IRS e-file Signature Authorization, Form 8888, Allocation of Refund (including savings bond purchases), Contract for Service

Agreement, and Refund Transfer Agreement). Do not send original returns or payments with this form.

14157

Form

(Rev. 10-2014)

Catalog Number 55242M

1

1 2

2 3

3 4

4