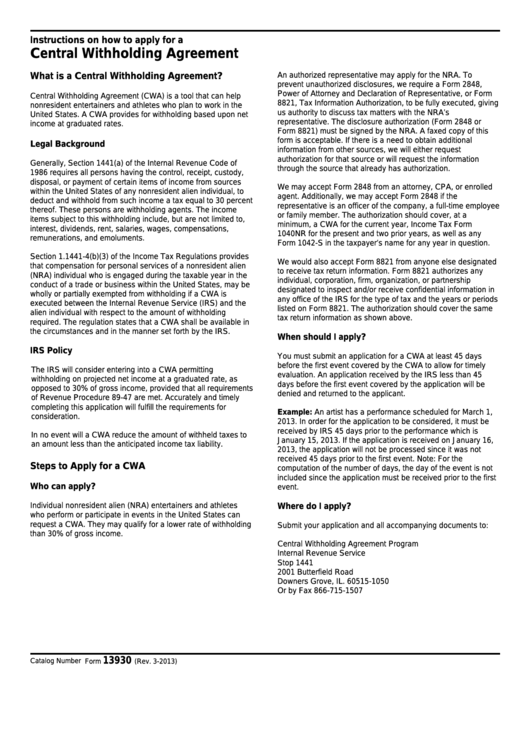

Instructions on how to apply for a

Central Withholding Agreement

An authorized representative may apply for the NRA. To

What is a Central Withholding Agreement?

prevent unauthorized disclosures, we require a Form 2848,

Power of Attorney and Declaration of Representative, or Form

Central Withholding Agreement (CWA) is a tool that can help

8821, Tax Information Authorization, to be fully executed, giving

nonresident entertainers and athletes who plan to work in the

us authority to discuss tax matters with the NRA’s

United States. A CWA provides for withholding based upon net

representative. The disclosure authorization (Form 2848 or

income at graduated rates.

Form 8821) must be signed by the NRA. A faxed copy of this

form is acceptable. If there is a need to obtain additional

Legal Background

information from other sources, we will either request

authorization for that source or will request the information

Generally, Section 1441(a) of the Internal Revenue Code of

through the source that already has authorization.

1986 requires all persons having the control, receipt, custody,

disposal, or payment of certain items of income from sources

We may accept Form 2848 from an attorney, CPA, or enrolled

within the United States of any nonresident alien individual, to

agent. Additionally, we may accept Form 2848 if the

deduct and withhold from such income a tax equal to 30 percent

representative is an officer of the company, a full-time employee

thereof. These persons are withholding agents. The income

or family member. The authorization should cover, at a

items subject to this withholding include, but are not limited to,

minimum, a CWA for the current year, Income Tax Form

interest, dividends, rent, salaries, wages, compensations,

1040NR for the present and two prior years, as well as any

remunerations, and emoluments.

Form 1042-S in the taxpayer’s name for any year in question.

Section 1.1441-4(b)(3) of the Income Tax Regulations provides

We would also accept Form 8821 from anyone else designated

that compensation for personal services of a nonresident alien

to receive tax return information. Form 8821 authorizes any

(NRA) individual who is engaged during the taxable year in the

individual, corporation, firm, organization, or partnership

conduct of a trade or business within the United States, may be

designated to inspect and/or receive confidential information in

wholly or partially exempted from withholding if a CWA is

any office of the IRS for the type of tax and the years or periods

executed between the Internal Revenue Service (IRS) and the

listed on Form 8821. The authorization should cover the same

alien individual with respect to the amount of withholding

tax return information as shown above.

required. The regulation states that a CWA shall be available in

the circumstances and in the manner set forth by the IRS.

When should I apply?

IRS Policy

You must submit an application for a CWA at least 45 days

before the first event covered by the CWA to allow for timely

The IRS will consider entering into a CWA permitting

evaluation. An application received by the IRS less than 45

withholding on projected net income at a graduated rate, as

days before the first event covered by the application will be

opposed to 30% of gross income, provided that all requirements

denied and returned to the applicant.

of Revenue Procedure 89-47 are met. Accurately and timely

completing this application will fulfill the requirements for

Example: An artist has a performance scheduled for March 1,

consideration.

2013. In order for the application to be considered, it must be

received by IRS 45 days prior to the performance which is

In no event will a CWA reduce the amount of withheld taxes to

January 15, 2013. If the application is received on January 16,

an amount less than the anticipated income tax liability.

2013, the application will not be processed since it was not

received 45 days prior to the first event. Note: For the

Steps to Apply for a CWA

computation of the number of days, the day of the event is not

included since the application must be received prior to the first

Who can apply?

event.

Individual nonresident alien (NRA) entertainers and athletes

Where do I apply?

who perform or participate in events in the United States can

request a CWA. They may qualify for a lower rate of withholding

Submit your application and all accompanying documents to:

than 30% of gross income.

Central Withholding Agreement Program

Internal Revenue Service

Stop 1441

2001 Butterfield Road

Downers Grove, IL. 60515-1050

Or by Fax 866-715-1507

13930

Catalog Number 50991Q

Form

(Rev. 3-2013)

1

1 2

2 3

3 4

4 5

5 6

6