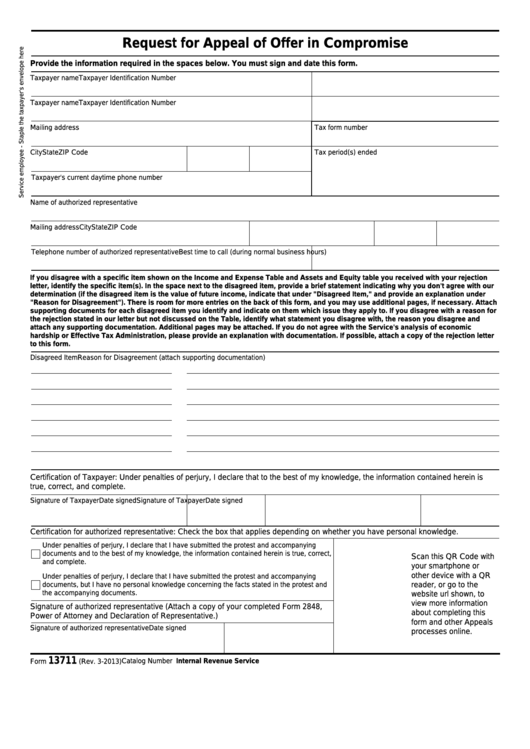

Request for Appeal of Offer in Compromise

Provide the information required in the spaces below. You must sign and date this form.

Taxpayer name

Taxpayer Identification Number

Taxpayer name

Taxpayer Identification Number

Mailing address

Tax form number

City

State

ZIP Code

Tax period(s) ended

Taxpayer's current daytime phone number

Name of authorized representative

Mailing address

City

State

ZIP Code

Telephone number of authorized representative

Best time to call (during normal business hours)

If you disagree with a specific item shown on the Income and Expense Table and Assets and Equity table you received with your rejection

letter, identify the specific item(s). In the space next to the disagreed item, provide a brief statement indicating why you don't agree with our

determination (if the disagreed item is the value of future income, indicate that under "Disagreed Item," and provide an explanation under

"Reason for Disagreement"). There is room for more entries on the back of this form, and you may use additional pages, if necessary. Attach

supporting documents for each disagreed item you identify and indicate on them which issue they apply to. If you disagree with a reason for

the rejection stated in our letter but not discussed on the Table, identify what statement you disagree with, the reason you disagree and

attach any supporting documentation. Additional pages may be attached. If you do not agree with the Service's analysis of economic

hardship or Effective Tax Administration, please provide an explanation with documentation. If possible, attach a copy of the rejection letter

to this form.

Disagreed Item

Reason for Disagreement (attach supporting documentation)

Certification of Taxpayer: Under penalties of perjury, I declare that to the best of my knowledge, the information contained herein is

true, correct, and complete.

Signature of Taxpayer

Date signed

Signature of Taxpayer

Date signed

Certification for authorized representative: Check the box that applies depending on whether you have personal knowledge.

Under penalties of perjury, I declare that I have submitted the protest and accompanying

documents and to the best of my knowledge, the information contained herein is true, correct,

Scan this QR Code with

and complete.

your smartphone or

s.gov/appeals

other device with a QR

Under penalties of perjury, I declare that I have submitted the protest and accompanying

documents, but I have no personal knowledge concerning the facts stated in the protest and

reader, or go to the

the accompanying documents.

website url shown, to

view more information

Signature of authorized representative (Attach a copy of your completed Form 2848,

about completing this

Power of Attorney and Declaration of Representative.)

form and other Appeals

Signature of authorized representative

Date signed

processes online.

13711

Catalog Number 40992F

Department of the Treasury - Internal Revenue Service

Form

(Rev. 3-2013)

1

1 2

2