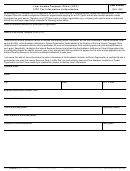

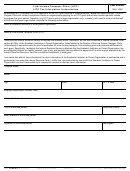

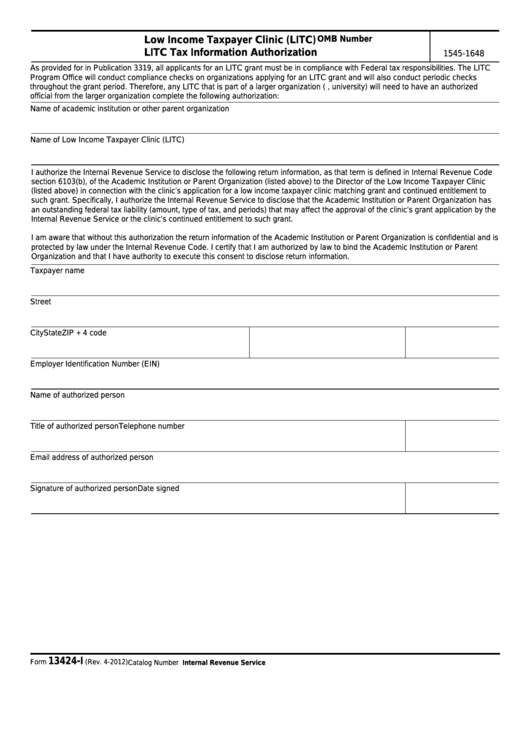

Low Income Taxpayer Clinic (LITC)

OMB Number

LITC Tax Information Authorization

1545-1648

As provided for in Publication 3319, all applicants for an LITC grant must be in compliance with Federal tax responsibilities. The LITC

Program Office will conduct compliance checks on organizations applying for an LITC grant and will also conduct periodic checks

throughout the grant period. Therefore, any LITC that is part of a larger organization (e.g., university) will need to have an authorized

official from the larger organization complete the following authorization:

Name of academic institution or other parent organization

Name of Low Income Taxpayer Clinic (LITC)

I authorize the Internal Revenue Service to disclose the following return information, as that term is defined in Internal Revenue Code

section 6103(b), of the Academic Institution or Parent Organization (listed above) to the Director of the Low Income Taxpayer Clinic

(listed above) in connection with the clinic’s application for a low income taxpayer clinic matching grant and continued entitlement to

such grant. Specifically, I authorize the Internal Revenue Service to disclose that the Academic Institution or Parent Organization has

an outstanding federal tax liability (amount, type of tax, and periods) that may affect the approval of the clinic’s grant application by the

Internal Revenue Service or the clinic’s continued entitlement to such grant.

I am aware that without this authorization the return information of the Academic Institution or Parent Organization is confidential and is

protected by law under the Internal Revenue Code. I certify that I am authorized by law to bind the Academic Institution or Parent

Organization and that I have authority to execute this consent to disclose return information.

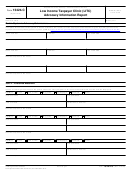

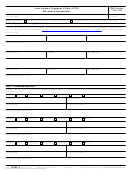

Taxpayer name

Street

City

State

ZIP + 4 code

Employer Identification Number (EIN)

Name of authorized person

Title of authorized person

Telephone number

Email address of authorized person

Signature of authorized person

Date signed

13424-I

Form

(Rev. 4-2012)

Catalog Number 57683F

Department of the Treasury - Internal Revenue Service

1

1