Form Rpd-41346 - New Mexico Geothermal Ground-Coupled Heat Pump Tax Credit Claim Form

ADVERTISEMENT

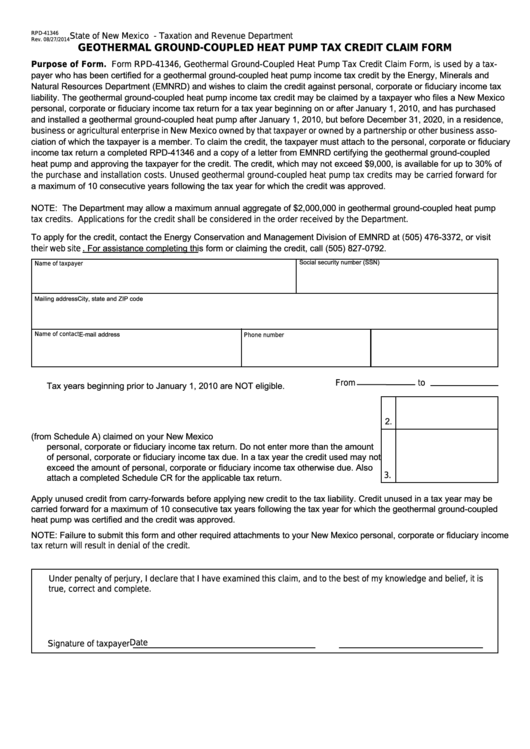

State of New Mexico - Taxation and Revenue Department

RPD-41346

Rev. 08/27/2014

GEOTHERMAL GROUND-COUPLED HEAT PUMP TAX CREDIT CLAIM FORM

Purpose of Form. Form RPD-41346, Geothermal Ground-Coupled Heat Pump Tax Credit Claim Form, is used by a tax-

payer who has been certified for a geothermal ground-coupled heat pump income tax credit by the Energy, Minerals and

Natural Resources Department (EMNRD) and wishes to claim the credit against personal, corporate or fiduciary income tax

liability. The geothermal ground-coupled heat pump income tax credit may be claimed by a taxpayer who files a New Mexico

personal, corporate or fiduciary income tax return for a tax year beginning on or after January 1, 2010, and has purchased

and installed a geothermal ground-coupled heat pump after January 1, 2010, but before December 31, 2020, in a residence,

business or agricultural enterprise in New Mexico owned by that taxpayer or owned by a partnership or other business asso-

ciation of which the taxpayer is a member. To claim the credit, the taxpayer must attach to the personal, corporate or fiduciary

income tax return a completed RPD-41346 and a copy of a letter from EMNRD certifying the geothermal ground-coupled

heat pump and approving the taxpayer for the credit. The credit, which may not exceed $9,000, is available for up to 30% of

the purchase and installation costs. Unused geothermal ground-coupled heat pump tax credits may be carried forward for

a maximum of 10 consecutive years following the tax year for which the credit was approved.

NOTE: The Department may allow a maximum annual aggregate of $2,000,000 in geothermal ground-coupled heat pump

tax credits. Applications for the credit shall be considered in the order received by the Department.

To apply for the credit, contact the Energy Conservation and Management Division of EMNRD at (505) 476-3372, or visit

their web site For assistance completing this form or claiming the credit, call (505) 827-0792.

Social security number (SSN)

Name of taxpayer

Mailing address

City, state and ZIP code

Name of contact

E-mail address

Phone number

1. Enter the beginning and ending date of the tax year of this claim.

From

to

Tax years beginning prior to January 1, 2010 are NOT eligible.

2. Enter the tax due for the tax year as shown on your return.

2.

3. Enter the portion of total credit available (from Schedule A) claimed on your New Mexico

personal, corporate or fiduciary income tax return. Do not enter more than the amount

of personal, corporate or fiduciary income tax due. In a tax year the credit used may not

exceed the amount of personal, corporate or fiduciary income tax otherwise due. Also

3.

attach a completed Schedule CR for the applicable tax return.

Apply unused credit from carry-forwards before applying new credit to the tax liability. Credit unused in a tax year may be

carried forward for a maximum of 10 consecutive tax years following the tax year for which the geothermal ground-coupled

heat pump was certified and the credit was approved.

NOTE: Failure to submit this form and other required attachments to your New Mexico personal, corporate or fiduciary income

tax return will result in denial of the credit.

Under penalty of perjury, I declare that I have examined this claim, and to the best of my knowledge and belief, it is

true, correct and complete.

Date

Signature of taxpayer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3