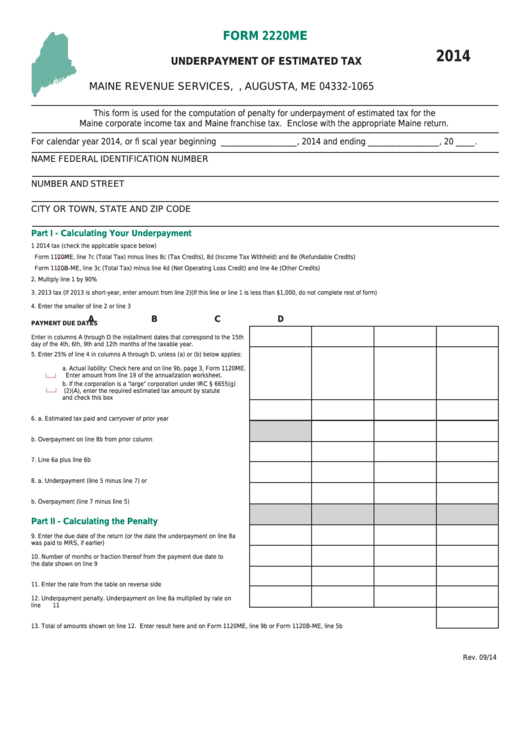

FORM 2220ME

2014

UNDERPAYMENT OF ESTIMATED TAX

MAINE REVENUE SERVICES, P.O. BOX 1065, AUGUSTA, ME 04332-1065

This form is used for the computation of penalty for underpayment of estimated tax for the

Maine corporate income tax and Maine franchise tax. Enclose with the appropriate Maine return.

For calendar year 2014, or fi scal year beginning ________________ , 2014 and ending _______________ , 20 ____ .

NAME

FEDERAL IDENTIFICATION NUMBER

NUMBER AND STREET

CITY OR TOWN, STATE AND ZIP CODE

Part I - Calculating Your Underpayment

1

2014 tax (check the applicable space below) ........................................................................................................................................... 1. ___________________________

Form 1120ME, line 7c (Total Tax) minus lines 8c (Tax Credits), 8d (Income Tax Withheld) and 8e (Refundable Credits)

Form 1120B-ME, line 3c (Total Tax) minus line 4d (Net Operating Loss Credit) and line 4e (Other Credits)

2.

Multiply line 1 by 90% ............................................................................................................................................................................... 2. ___________________________

3.

2013 tax (If 2013 is short-year, enter amount from line 2)(If this line or line 1 is less than $1,000, do not complete rest of form) ........... 3. ___________________________

4.

Enter the smaller of line 2 or line 3 ........................................................................................................................................................... 4. ___________________________

A

B

C

D

PAYMENT DUE DATES

Enter in columns A through D the installment dates that correspond to the 15th

day of the 4th, 6th, 9th and 12th months of the taxable year.

5.

Enter 25% of line 4 in columns A through D, unless (a) or (b) below applies:

a.

Actual liability: Check here and on line 9b, page 3, Form 1120ME.

Enter amount from line 19 of the annualization worksheet.

b.

If the corporation is a “large” corporation under IRC § 6655(g)

(2)(A), enter the required estimated tax amount by statute

and check this box ...................................................................5.

6.

a.

Estimated tax paid and carryover of prior year overpayment............6a.

b.

Overpayment on line 8b from prior column .......................................6b.

7.

Line 6a plus line 6b ....................................................................................7.

8.

a.

Underpayment (line 5 minus line 7) or ..............................................8a.

b.

Overpayment (line 7 minus line 5) ....................................................8b.

Part II - Calculating the Penalty

9.

Enter the due date of the return (or the date the underpayment on line 8a

was paid to MRS, if earlier) ........................................................................9.

10. Number of months or fraction thereof from the payment due date to

the date shown on line 9 ..........................................................................10.

11. Enter the rate from the table on reverse side ...........................................11.

12. Underpayment penalty. Underpayment on line 8a multiplied by rate on

line 11 .......................................................................................................12.

13. Total of amounts shown on line 12. Enter result here and on Form 1120ME, line 9b or Form 1120B-ME, line 5b ............................................... 13.

Rev. 09/14

1

1 2

2