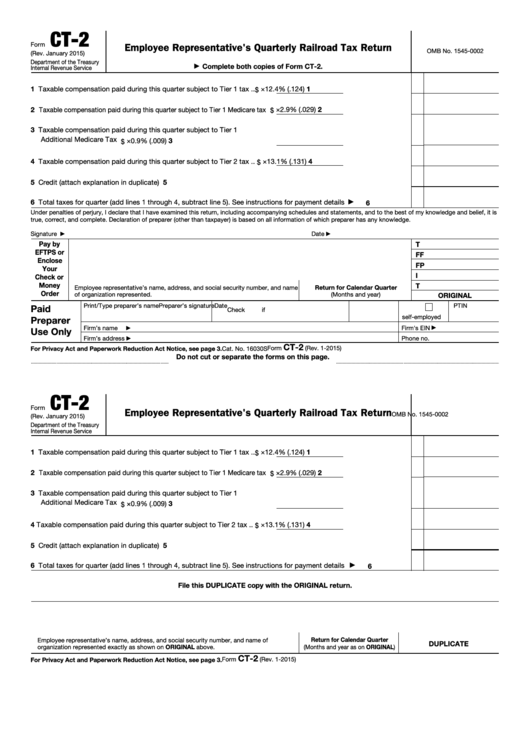

CT-2

Form

Employee Representative's Quarterly Railroad Tax Return

OMB No. 1545-0002

(Rev. January 2015)

Department of the Treasury

Complete both copies of Form CT-2.

▶

Internal Revenue Service

1 Taxable compensation paid during this quarter subject to Tier 1 tax .

.

×

12.4% (.124)

1

$

2 Taxable compensation paid during this quarter subject to Tier 1 Medicare tax

×

2.9% (.029)

2

$

3 Taxable compensation paid during this quarter subject to Tier 1

Additional Medicare Tax

.

.

.

.

.

.

.

.

.

.

.

.

.

3

×

0.9% (.009)

$

4 Taxable compensation paid during this quarter subject to Tier 2 tax .

.

×

13.1% (.131)

4

$

5 Credit (attach explanation in duplicate)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6 Total taxes for quarter (add lines 1 through 4, subtract line 5). See instructions for payment details .

.

.

.

.

6

▶

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Signature

Date

▶

▶

Pay by

T

EFTPS or

FF

Enclose

FP

Your

I

Check or

Money

T

Return for Calendar Quarter

Employee representative’s name, address, and social security number, and name

Order

of organization represented.

(Months and year)

ORIGINAL

Print/Type preparer’s name

Preparer’s signature

Date

PTIN

Paid

Check

if

self-employed

Preparer

Firm’s name

Firm's EIN

Use Only

▶

▶

Firm’s address

Phone no.

▶

CT-2

Form

(Rev. 1-2015)

For Privacy Act and Paperwork Reduction Act Notice, see page 3.

IRS.gov/ct2

Cat. No. 16030S

Do not cut or separate the forms on this page.

CT-2

Form

Employee Representative's Quarterly Railroad Tax Return

OMB No. 1545-0002

(Rev. January 2015)

Department of the Treasury

Internal Revenue Service

1 Taxable compensation paid during this quarter subject to Tier 1 tax .

.

×

12.4% (.124)

1

$

2 Taxable compensation paid during this quarter subject to Tier 1 Medicare tax

2

×

2.9% (.029)

$

3 Taxable compensation paid during this quarter subject to Tier 1

Additional Medicare Tax

.

.

.

.

.

.

.

.

.

.

.

.

.

.

×

0.9% (.009)

3

$

4 Taxable compensation paid during this quarter subject to Tier 2 tax .

.

×

13.1% (.131)

4

$

5 Credit (attach explanation in duplicate)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6 Total taxes for quarter (add lines 1 through 4, subtract line 5). See instructions for payment details .

.

.

.

.

6

▶

File this DUPLICATE copy with the ORIGINAL return.

Return for Calendar Quarter

Employee representative’s name, address, and social security number, and name of

DUPLICATE

organization represented exactly as shown on ORIGINAL above.

(Months and year as on ORIGINAL)

CT-2

Form

(Rev. 1-2015)

For Privacy Act and Paperwork Reduction Act Notice, see page 3.

IRS.gov/ct2

Cat. No. 16030S

1

1 2

2 3

3