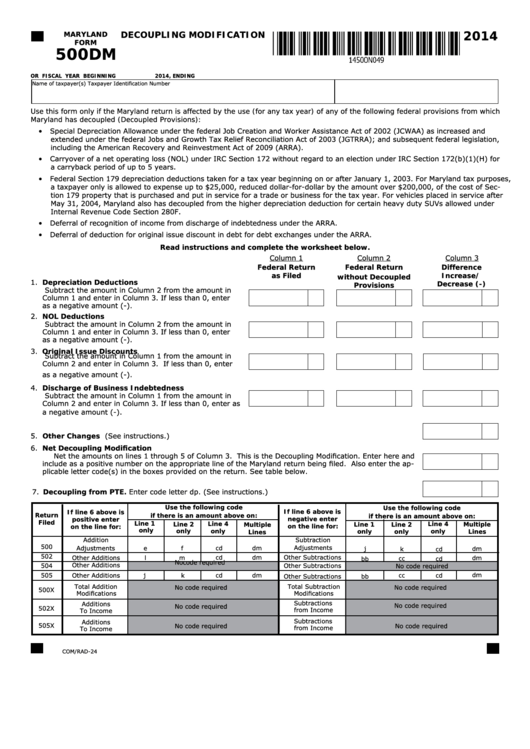

2014

DECOUPLING MODIFICATION

MARYLAND

FORM

500DM

OR FISCAL YEAR BEGINNING

2014, ENDING

Name of taxpayer(s)

Taxpayer Identification Number

Use this form only if the Maryland return is affected by the use (for any tax year) of any of the following federal provisions from which

Maryland has decoupled (Decoupled Provisions):

• Special Depreciation Allowance under the federal Job Creation and Worker Assistance Act of 2002 (JCWAA) as increased and

extended under the federal Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA); and subsequent federal legislation,

including the American Recovery and Reinvestment Act of 2009 (ARRA).

• Carryover of a net operating loss (NOL) under IRC Section 172 without regard to an election under IRC Section 172(b)(1)(H) for

a carryback period of up to 5 years.

• Federal Section 179 depreciation deductions taken for a tax year beginning on or after January 1, 2003. For Maryland tax purposes,

a taxpayer only is allowed to expense up to $25,000, reduced dollar-for-dollar by the amount over $200,000, of the cost of Sec-

tion 179 property that is purchased and put in service for a trade or business for the tax year. For vehicles placed in service after

May 31, 2004, Maryland also has decoupled from the higher depreciation deduction for certain heavy duty SUVs allowed under

Internal Revenue Code Section 280F.

• Deferral of recognition of income from discharge of indebtedness under the ARRA.

• Deferral of deduction for original issue discount in debt for debt exchanges under the ARRA.

Read instructions and complete the worksheet below.

Column 1

Column 2

Column 3

Federal Return

Federal Return

Difference

as Filed

Increase/

without Decoupled

1. Depreciation Deductions

Decrease (-)

Provisions

Subtract the amount in Column 2 from the amount in

Column 1 and enter in Column 3. If less than 0, enter

as a negative amount (-).

2. NOL Deductions

Subtract the amount in Column 2 from the amount in

Column 1 and enter in Column 3. If less than 0, enter

as a negative amount (-).

3. Original Issue Discounts

S ubtract the amount in Column 1 from the amount in

Column 2 and enter in Column 3. If less than 0, enter

as a negative amount (-).

4. Discharge of Business Indebtedness

Subtract the amount in Column 1 from the amount in

Column 2 and enter in Column 3. If less than 0, enter as

a negative amount (-).

5. Other Changes (See instructions.) ....................................................................................................

6. Net Decoupling Modification

Net the amounts on lines 1 through 5 of Column 3. This is the Decoupling Modification. Enter here and

include as a positive number on the appropriate line of the Maryland return being filed. Also enter the ap-

plicable letter code(s) in the boxes provided on the return. See table below.

7. Decoupling from PTE. Enter code letter dp. (See instructions.) . ............................................................

Use the following code

Use the following code

If line 6 above is

If line 6 above is

Return

if there is an amount above on:

if there is an amount above on:

negative enter

positive enter

Filed

Line 1

Line 4

Line 4

Line 2

Multiple

Multiple

Line 1

Line 2

on the line for:

on the line for:

only

only

only

only

only

only

Lines

Lines

Addition

Subtraction

500

Adjustments

Adjustments

e

f

cd

dm

j

dm

k

cd

502

Other Subtractions

Other Additions

l

m

cd

dm

dm

bb

cc

cd

Other Additions

No code required

504

Other Subtractions

No code required

dm

505

Other Additions

j

k

cd

dm

cc

cd

Other Subtractions

bb

Total Addition

Total Subtraction

No code required

No code required

500X

Modifications

Modifications

Subtractions

Additions

No code required

No code required

502X

from Income

To Income

Subtractions

Additions

505X

No code required

No code required

from Income

To Income

COM/RAD-24

1

1 2

2