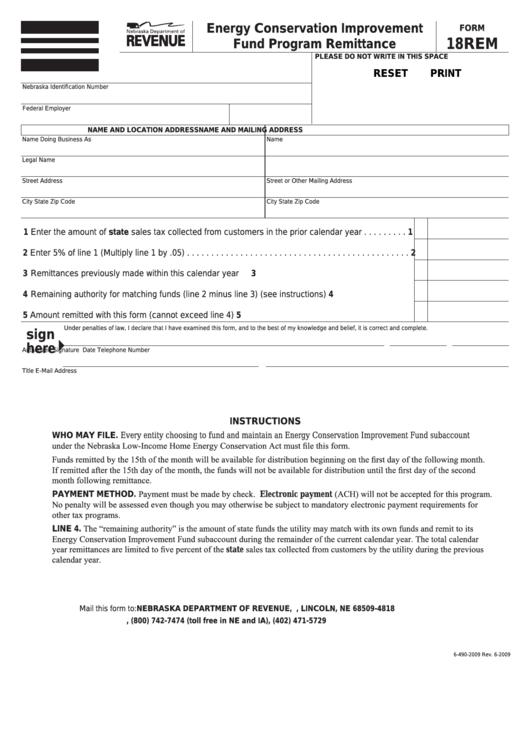

Energy Conservation Improvement

FORM

18REM

Fund Program Remittance

PLEASE DO NOT WRITE IN ThIS SPACE

RESET

PRINT

Nebraska Identification Number

Federal Employer I .D .

Month and Year of Remittance

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

Name Doing Business As

Name

Legal Name

Street Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

1 Enter the amount of state sales tax collected from customers in the prior calendar year . . . . . . . . .

1

2 Enter 5% of line 1 (Multiply line 1 by .05) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Remittances previously made within this calendar year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Remaining authority for matching funds (line 2 minus line 3) (see instructions) . . . . . . . . . . . . . . . . .

4

5 Amount remitted with this form (cannot exceed line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Under penalties of law, I declare that I have examined this form, and to the best of my knowledge and belief, it is correct and complete .

sign

here

Authorized Signature

Date

Telephone Number

Title

E-Mail Address

INSTRUCTIONS

WhO MAY FILE. Every entity choosing to fund and maintain an Energy Conservation Improvement Fund subaccount

under the Nebraska Low-Income Home Energy Conservation Act must file this form.

Funds remitted by the 15th of the month will be available for distribution beginning on the first day of the following month.

If remitted after the 15th day of the month, the funds will not be available for distribution until the first day of the second

month following remittance.

PAYMENT METhOD. Payment must be made by check. Electronic payment (ACH) will not be accepted for this program.

No penalty will be assessed even though you may otherwise be subject to mandatory electronic payment requirements for

other tax programs.

LINE 4. The “remaining authority” is the amount of state funds the utility may match with its own funds and remit to its

Energy Conservation Improvement Fund subaccount during the remainder of the current calendar year. The total calendar

year remittances are limited to five percent of the state sales tax collected from customers by the utility during the previous

calendar year.

Mail this form to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

, (800) 742-7474 (toll free in NE and IA), (402) 471-5729

6-490-2009 Rev . 6-2009

1

1