Form 6xn - Amended Nebraska Sales/use Tax And Tire Fee Statement

ADVERTISEMENT

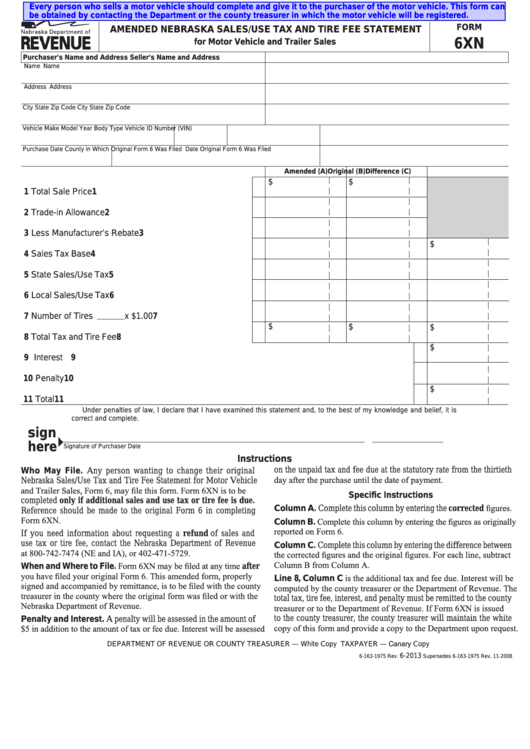

Every person who sells a motor vehicle should complete and give it to the purchaser of the motor vehicle. This form can

be obtained by contacting the Department or the county treasurer in which the motor vehicle will be registered.

FORM

AMENDED NEBRASKA SALES/USE TAX AND TIRE FEE STATEMENT

6XN

for Motor Vehicle and Trailer Sales

Purchaser’s Name and Address

Seller’s Name and Address

Name

Name

Address

Address

City

State

Zip Code

City

State

Zip Code

Vehicle Make

Model Year

Body Type

Vehicle ID Number (VIN)

Purchase Date

County in Which Original Form 6 Was Filed

Date Original Form 6 Was Filed

Amended (A)

Original (B)

Difference (C)

$

$

1 Total Sale Price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Trade-in Allowance . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Less Manufacturer’s Rebate . . . . . . . . . . . . . . . . . . . . . .

3

$

4 Sales Tax Base . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 State Sales/Use Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Local Sales/Use Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Number of Tires

x $1.00 . . . . . . . . . . . . . . . . . . .

7

$

$

$

8 Total Tax and Tire Fee . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

$

9 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

$

11 Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Under penalties of law, I declare that I have examined this statement and, to the best of my knowledge and belief, it is

correct and complete.

sign

here

Signature of Purchaser

Date

Instructions

on the unpaid tax and fee due at the statutory rate from the thirtieth

Who May File. Any person wanting to change their original

day after the purchase until the date of payment.

Nebraska Sales/Use Tax and Tire Fee Statement for Motor Vehicle

and Trailer Sales, Form 6, may file this form. Form 6XN is to be

Specific Instructions

completed only if additional sales and use tax or tire fee is due.

Column A. Complete this column by entering the corrected figures.

Reference should be made to the original Form 6 in completing

Form 6XN.

Column B. Complete this column by entering the figures as originally

reported on Form 6.

If you need information about requesting a refund of sales and

use tax or tire fee, contact the Nebraska Department of Revenue

Column C. Complete this column by entering the difference between

at 800-742-7474 (NE and IA), or 402-471-5729.

the corrected figures and the original figures. For each line, subtract

Column B from Column A.

When and Where to File. Form 6XN may be filed at any time after

you have filed your original Form 6. This amended form, properly

Line 8, Column C is the additional tax and fee due. Interest will be

signed and accompanied by remittance, is to be filed with the county

computed by the county treasurer or the Department of Revenue. The

treasurer in the county where the original form was filed or with the

total tax, tire fee, interest, and penalty must be remitted to the county

Nebraska Department of Revenue.

treasurer or to the Department of Revenue. If Form 6XN is issued

to the county treasurer, the county treasurer will maintain the white

Penalty and Interest. A penalty will be assessed in the amount of

copy of this form and provide a copy to the Department upon request.

$5 in addition to the amount of tax or fee due. Interest will be assessed

TAXPAYER — Canary Copy

DEPARTMENT OF REVENUE OR COUNTY TREASURER — White Copy

6-2013

6-163-1975 Rev.

Supersedes 6-163-1975 Rev. 11-2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1