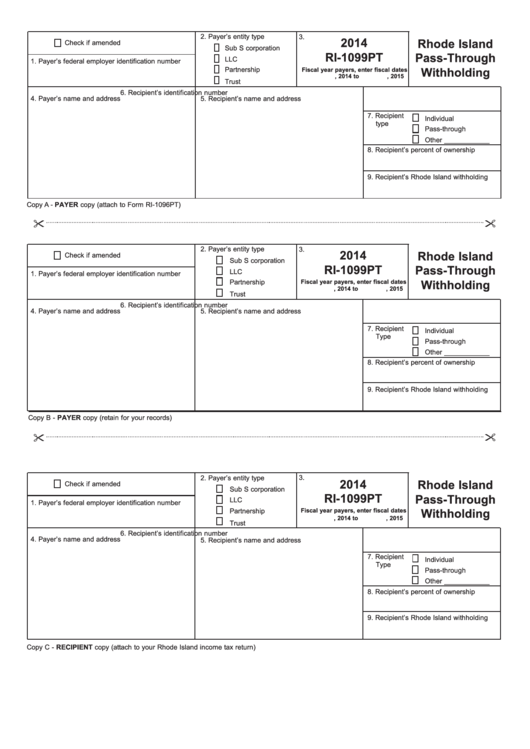

Form Ri-1099pt - Rhode Island Pass-Through Withholding - 2014

ADVERTISEMENT

2. Payer’s entity type

3.

2014

Rhode Island

Check if amended

Sub S corporation

RI-1099PT

Pass-Through

LLC

1. Payer’s federal employer identification number

Partnership

Fiscal year payers, enter fiscal dates

Withholding

, 2014 to

, 2015

Trust

6. Recipient’s identification number

4. Payer’s name and address

5. Recipient’s name and address

7. Recipient

Individual

type

Pass-through

Other ____________

8. Recipient’s percent of ownership

9. Recipient’s Rhode Island withholding

Copy A - PAYER copy (attach to Form RI-1096PT)

"

2. Payer’s entity type

3.

2014

Rhode Island

Check if amended

Sub S corporation

RI-1099PT

Pass-Through

LLC

1. Payer’s federal employer identification number

Fiscal year payers, enter fiscal dates

Partnership

Withholding

, 2014 to

, 2015

Trust

6. Recipient’s identification number

4. Payer’s name and address

5. Recipient’s name and address

7. Recipient

Individual

Type

Pass-through

Other ____________

8. Recipient’s percent of ownership

9. Recipient’s Rhode Island withholding

Copy B - PAYER copy (retain for your records)

"

3.

2. Payer’s entity type

2014

Rhode Island

Check if amended

Sub S corporation

RI-1099PT

Pass-Through

LLC

1. Payer’s federal employer identification number

Partnership

Fiscal year payers, enter fiscal dates

Withholding

, 2014 to

, 2015

Trust

6. Recipient’s identification number

4. Payer’s name and address

5. Recipient’s name and address

7. Recipient

Individual

Type

Pass-through

Other ____________

8. Recipient’s percent of ownership

9. Recipient’s Rhode Island withholding

Copy C - RECIPIENT copy (attach to your Rhode Island income tax return)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2