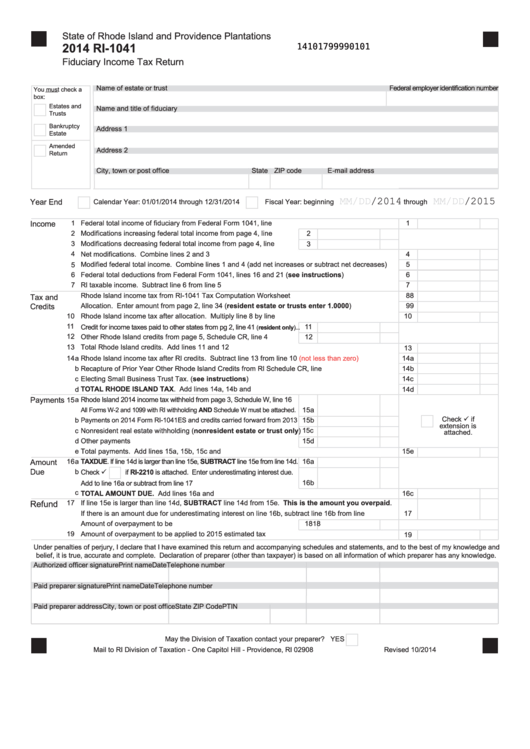

State of Rhode Island and Providence Plantations

2014 RI-1041

14101799990101

Fiduciary Income Tax Return

Name of estate or trust

Federal employer identification number

You must check a

box:

Estates and

Name and title of fiduciary

Trusts

Bankruptcy

Address 1

Estate

Amended

Address 2

Return

City, town or post office

State ZIP code

E-mail address

MM/DD/2014

MM/DD/2015

Year End

Calendar Year: 01/01/2014 through 12/31/2014

Fiscal Year: beginning

through

Income

1

Federal total income of fiduciary from Federal Form 1041, line 9...............................................................

1

2

Modifications increasing federal total income from page 4, line 2h.........

2

3

Modifications decreasing federal total income from page 4, line 3u........

3

Net modifications. Combine lines 2 and 3 .................................................................................................

4

4

5

Modified federal total income. Combine lines 1 and 4 (add net increases or subtract net decreases) .....

5

6

Federal total deductions from Federal Form 1041, lines 16 and 21 (see instructions) ............................

6

7

RI taxable income. Subtract line 6 from line 5 ...........................................................................................

7

8

Rhode Island income tax from RI-1041 Tax Computation Worksheet ........................................................

8

Tax and

9

Allocation. Enter amount from page 2, line 34 (resident estate or trusts enter 1.0000) ........................

9

Credits

10

Rhode Island income tax after allocation. Multiply line 8 by line 9.............................................................

10

11

11

Credit for income taxes paid to other states from pg 2, line 41

(resident only)...

12

Other Rhode Island credits from page 5, Schedule CR, line 4 ..............

12

13

Total Rhode Island credits. Add lines 11 and 12 ........................................................................................

13

14

a

Rhode Island income tax after RI credits. Subtract line 13 from line 10

(not less than zero)

...................

14a

b

Recapture of Prior Year Other Rhode Island Credits from RI Schedule CR, line 7.....................................

14b

c

Electing Small Business Trust Tax. (see instructions)...............................................................................

14c

d

TOTAL RHODE ISLAND TAX. Add lines 14a, 14b and 14c.....................................................................

14d

Payments

a

Rhode Island 2014 income tax withheld from page 3, Schedule W, line 16

15a

All Forms W-2 and 1099 with RI withholding AND Schedule W must be attached.

Check ü if

b

Payments on 2014 Form RI-1041ES and credits carried forward from 2013 15b

extension is

c

Nonresident real estate withholding (nonresident estate or trust only) 15c

attached.

d

Other payments ......................................................................................

15d

Total payments. Add lines 15a, 15b, 15c and 15d......................................................................................

TAX DUE. If line 14d is larger than line 15e, SUBTRACT line 15e from line 14d.

Amount

16

a

16a

Check ü

Due

b

if RI-2210 is attached. Enter underestimating interest due.

Add to line 16a or subtract from line 17

16b

c

TOTAL AMOUNT DUE. Add lines 16a and 16b......................................................................................... 16c

17

If line 15e is larger than line 14d, SUBTRACT line 14d from 15e. This is the amount you overpaid.

Refund

If there is an amount due for underestimating interest on line 16b, subtract line 16b from line 17.............

17

18

Amount of overpayment to be refunded.................................................. 18

19

Amount of overpayment to be applied to 2015 estimated tax .................................................................... 19

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, accurate and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Authorized officer signature

Print name

Date

Telephone number

Paid preparer signature

Print name

Date

Telephone number

Paid preparer address

City, town or post office

State

ZIP Code

PTIN

May the Division of Taxation contact your preparer? YES

Mail to RI Division of Taxation - One Capitol Hill - Providence, RI 02908

Revised 10/2014

1

1 2

2