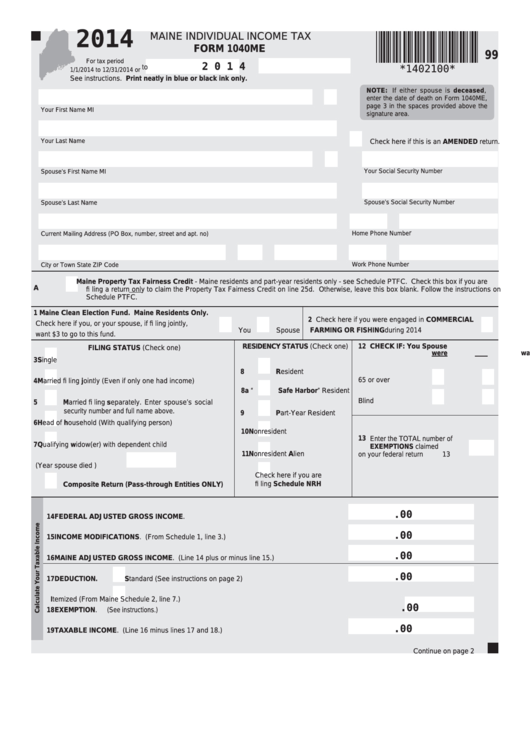

2014

MAINE INDIVIDUAL INCOME TAX

FORM 1040ME

99

For tax period

2 0 1 4

to

*1402100*

1/1/2014 to 12/31/2014 or

See instructions. Print neatly in blue or black ink only.

NOTE: If either spouse is deceased,

enter the date of death on Form 1040ME,

page 3 in the spaces provided above the

Your First Name

MI

signature area.

Your Last Name

Check here if this is an AMENDED return.

Your Social Security Number

Spouse’s First Name

MI

Spouse’s Social Security Number

Spouse’s Last Name

r

Home Phone Numbe

Current Mailing Address (PO Box, number, street and apt. no)

Work Phone Number

City or Town

State

ZIP Code

Maine Property Tax Fairness Credit - Maine residents and part-year residents only - see Schedule PTFC. Check this box if you are

A

fi ling a return only to claim the Property Tax Fairness Credit on line 25d. Otherwise, leave this box blank. Follow the instructions on

Schedule PTFC.

1

Maine Clean Election Fund. Maine Residents Only.

2 Check here if you were engaged in COMMERCIAL

Check here if you, or your spouse, if fi ling jointly,

FARMING OR FISHING during 2014 .....................

You

Spouse

want $3 to go to this fund.

RESIDENCY STATUS (Check one)

12 CHECK IF:

You

Spouse

FILING STATUS (Check one)

were

was

3

Single

8

Resident

65 or over ........ 12a

12c

4

Married fi ling jointly (Even if only one had income)

8a

“Safe Harbor” Resident

Blind................. 12b

12d

5

Married fi ling separately. Enter spouse’s social

security number and full name above.

9

Part-Year Resident

6

Head of household (With qualifying person)

10

Nonresident

13 Enter the TOTAL number of

7

Qualifying widow(er) with dependent child

EXEMPTIONS claimed

11

Nonresident Alien

on your federal return ....13

(Year spouse died

)

Check here if you are

fi ling Schedule NRH

Composite Return (Pass-through Entities ONLY)

.00

14

FEDERAL ADJUSTED GROSS INCOME. ............................................................... 14

.00

15

INCOME MODIFICATIONS. (From Schedule 1, line 3.) .......................................... 15

.00

16

MAINE ADJUSTED GROSS INCOME. (Line 14 plus or minus line 15.) ................. 16

.00

17

DEDUCTION.

Standard (See instructions on page 2) ................................. 17

Itemized (From Maine Schedule 2, line 7.)

.00

18

EXEMPTION. (See instructions.) ............................................................................................................... 18

.00

19

TAXABLE INCOME. (Line 16 minus lines 17 and 18.) ........................................... 19

Continue on page 2

1

1 2

2 3

3