Form Ri-1040v - Rhode Island Return Payment Voucher - 2014

ADVERTISEMENT

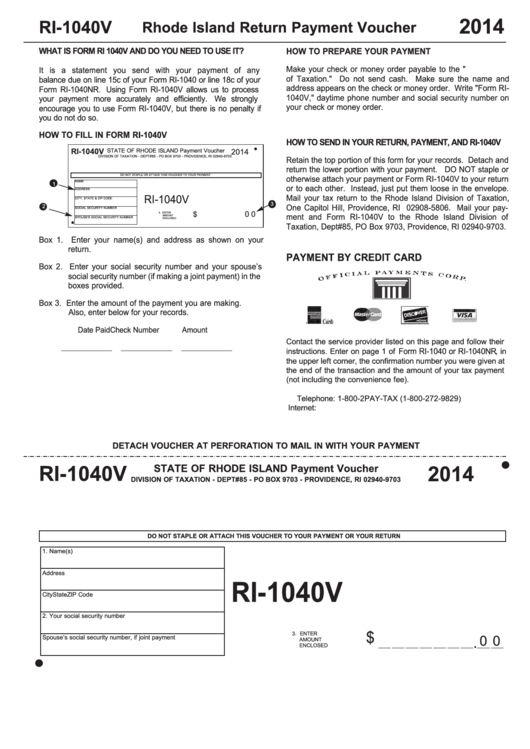

2014

RI-1040V

Rhode Island Return Payment Voucher

WHAT IS FORM RI 1040V AND DO YOU NEED TO USE IT?

HOW TO PREPARE YOUR PAYMENT

Make your check or money order payable to the "R.I. Division

It is a statement you send with your payment of any

of Taxation." Do not send cash. Make sure the name and

balance due on line 15c of your Form RI-1040 or line 18c of your

address appears on the check or money order. Write "Form RI-

Form RI-1040NR. Using Form RI-1040V allows us to process

1040V," daytime phone number and social security number on

your payment more accurately and efficiently.

We strongly

your check or money order.

encourage you to use Form RI-1040V, but there is no penalty if

you do not do so.

HOW TO FILL IN FORM RI-1040V

HOW TO SEND IN YOUR RETURN, PAYMENT, AND RI-1040V

RI-1040V

STATE OF RHODE ISLAND Payment Voucher

2014

DIVISION OF TAXATION - DEPT#85 - PO BOX 9703 - PROVIDENCE, RI 02940-9703

Retain the top portion of this form for your records. Detach and

return the lower portion with your payment. DO NOT staple or

DO NOT STAPLE OR ATTACH THIS VOUCHER TO YOUR PAYMENT

otherwise attach your payment or Form RI-1040V to your return

NAME

3

1

or to each other. Instead, just put them loose in the envelope.

ADDRESS

Mail your tax return to the Rhode Island Division of Taxation,

RI-1040V

CITY, STATE & ZIP CODE

3

2

One Capitol Hill, Providence, RI 02908-5806. Mail your pay-

SOCIAL SECURITY NUMBER

0 0

4. ENTER

$

ment and Form RI-1040V to the Rhode Island Division of

AMOUNT

SPOUSE'S SOCIAL SECURITY NUMBER

ENCLOSED

Taxation, Dept#85, PO Box 9703, Providence, RI 02940-9703.

Box 1. Enter your name(s) and address as shown on your

return.

PAYMENT BY CREDIT CARD

Box 2. Enter your social security number and your spouse’s

social security number (if making a joint payment) in the

boxes provided.

Box 3. Enter the amount of the payment you are making.

Also, enter below for your records.

Date Paid

Check Number

Amount

Contact the service provider listed on this page and follow their

Form RI-1040 or RI-1040NR

instructions. Enter on page 1 of

, in

the upper left corner, the confirmation number you were given at

the end of the transaction and the amount of your tax payment

(not including the convenience fee).

Telephone: 1-800-2PAY-TAX (1-800-272-9829)

Internet:

DETACH VOUCHER AT PERFORATION TO MAIL IN WITH YOUR PAYMENT

STATE OF RHODE ISLAND Payment Voucher

RI-1040V

2014

DIVISION OF TAXATION - DEPT#85 - PO BOX 9703 - PROVIDENCE, RI 02940-9703

DO NOT STAPLE OR ATTACH THIS VOUCHER TO YOUR PAYMENT OR YOUR RETURN

1. Name(s)

Address

RI-1040V

City

State

ZIP Code

2. Your social security number

3. ENTER

$

Spouse’s social security number, if joint payment

0 0

AMOUNT

ENCLOSED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1