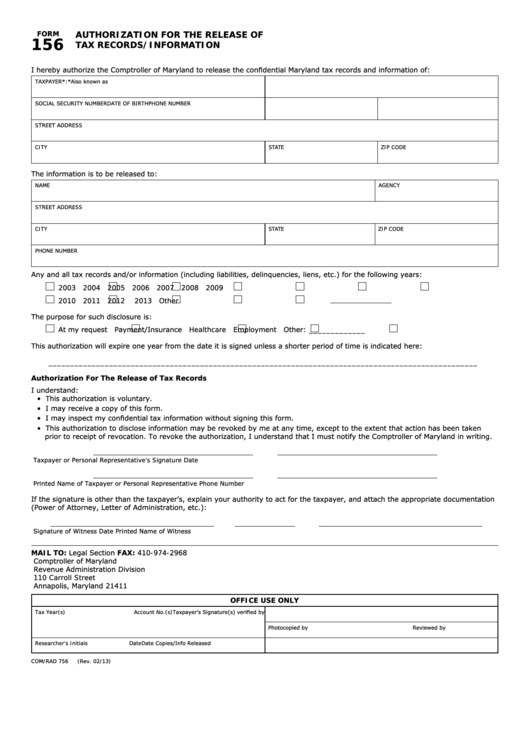

AUTHORIZATION FOR THE RELEASE OF

FORM

156

TAX RECORDS/INFORMATION

I hereby authorize the Comptroller of Maryland to release the confidential Maryland tax records and information of:

TAXPAYER*:

*Also known as

SOCIAL SECURITY NUMBER

DATE OF BIRTH

PHONE NUMBER

STREET ADDRESS

CITY

STATE

ZIP CODE

The information is to be released to:

NAME

AGENCY

STREET ADDRESS

CITY

STATE

ZIP CODE

PHONE NUMBER

Any and all tax records and/or information (including liabilities, delinquencies, liens, etc.) for the following years:

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Other

The purpose for such disclosure is:

At my request

Payment/Insurance

Healthcare

Employment

Other: _____________

This authorization will expire one year from the date it is signed unless a shorter period of time is indicated here:

___________________________________________________________________________________________________

Authorization For The Release of Tax Records

I understand:

• This authorization is voluntary.

• I may receive a copy of this form.

• I may inspect my confidential tax information without signing this form.

• This authorization to disclose information may be revoked by me at any time, except to the extent that action has been taken

prior to receipt of revocation. To revoke the authorization, I understand that I must notify the Comptroller of Maryland in writing.

Taxpayer or Personal Representative’s Signature

Date

Printed Name of Taxpayer or Personal Representative

Phone Number

If the signature is other than the taxpayer’s, explain your authority to act for the taxpayer, and attach the appropriate documentation

(Power of Attorney, Letter of Administration, etc.):

Signature of Witness

Date

Printed Name of Witness

MAIL TO:

Legal Section

FAX:

410-974-2968

Comptroller of Maryland

Revenue Administration Division

110 Carroll Street

Annapolis, Maryland 21411

OFFICE USE ONLY

Tax Year(s)

Account No.(s)

Taxpayer’s Signature(s) verified by

Photocopied by

Reviewed by

Researcher’s Initials

Date

Date Copies/Info Released

COM/RAD 756

(Rev. 02/13)

1

1