Help

Press here to Print this Form

Reset Form

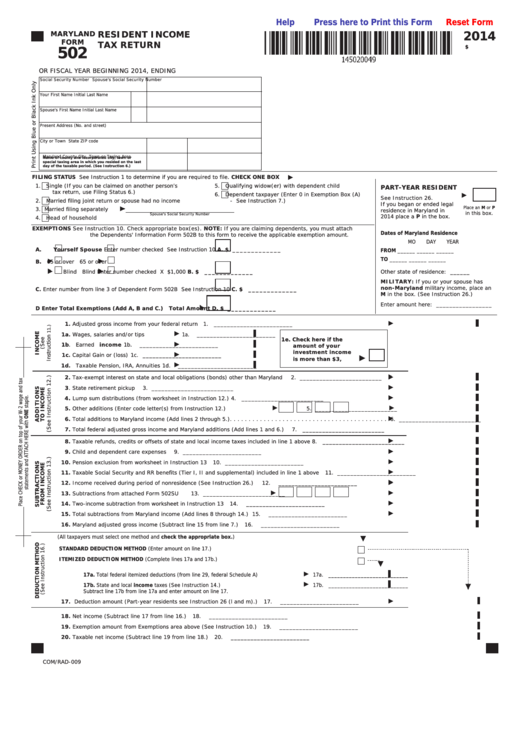

2014

RESIDENT INCOME

MARYLAND

FORM

TAX RETURN

502

$

OR FISCAL YEAR BEGINNING

2014, ENDING

Social Security Number

Spouse's Social Security Number

Your First Name

Initial Last Name

Spouse's First Name

Initial Last Name

Present Address (No . and street)

City or Town

State

ZIP code

Maryland County

City, Town or Taxing Area

Name of county and incorporated city, town or

special taxing area in which you resided on the last

day of the taxable period. (See Instruction 6.)

FILING STATUS See Instruction 1 to determine if you are required to file . CHECK ONE BOX

1 .

Single (If you can be claimed on another person’s

5 .

Qualifying widow(er) with dependent child

PART-YEAR RESIDENT

tax return, use Filing Status 6 .)

6 .

Dependent taxpayer (Enter 0 in Exemption Box (A)

See Instruction 26 .

2 .

Married filing joint return or spouse had no income

- See Instruction 7 .)

If you began or ended legal

Place an M or P

3 .

Married filing separately

residence in Maryland in

in this box .

Spouse's Social Security Number

2014 place a P in the box .

4 .

Head of household

EXEMPTIONS

See Instruction 10 . Check appropriate box(es) . NOTE: If you are claiming dependents, you must attach

Dates of Maryland Residence

the Dependents' Information Form 502B to this form to receive the applicable exemption amount .

MO

DAY

YEAR

A.

Yourself

Spouse

Enter number checked

See Instruction 10

A. $ _____________

FROM

______ ______ ______

TO

______ ______ ______

B.

65 or over

65 or over

Blind

Blind

Enter number checked

X $1,000

B. $ _____________

Other state of residence: ______

MILITARY: If you or your spouse has

non-Maryland military income, place an

C.

C. $ _____________

Enter number from line 3 of Dependent Form 502B

See Instruction 10

M in the box . (See Instruction 26 .)

Enter amount here: _________________

D

Enter Total Exemptions (Add A, B and C.)

Total Amount

D. $ _____________

1. Adjusted gross income from your federal return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 . ________________________

1a. Wages, salaries and/or tips . . . . . . .

1a .

________________________

1e. Check here if the

1b . Earned income . . . . . . . . . . . . . . .

1b .

________________________

amount of your

investment income

1c. Capital Gain or (loss) . . . . . . . . . . .

1c .

________________________

is more than $3,350...

1d. Taxable Pension, IRA, Annuities . . . .

1d .

________________________

2. Tax-exempt interest on state and local obligations (bonds) other than Maryland . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 . _________________________

3 . State retirement pickup . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 . _________________________

4. Lump sum distributions (from worksheet in Instruction 12 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 . _________________________

5. Other additions (Enter code letter(s) from Instruction 12 .) . . . . . . . . . . . .

. . . . . . . . .

5 . _________________________

6. Total additions to Maryland income (Add lines 2 through 5 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 . _________________________

7. Total federal adjusted gross income and Maryland additions (Add lines 1 and 6 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 . _________________________

8. Taxable refunds, credits or offsets of state and local income taxes included in line 1 above . . . . . . . . . . . . . . . . . . . .

8 . _________________________

9. Child and dependent care expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 . ________________________

10. Pension exclusion from worksheet in Instruction 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 . ________________________

11. Taxable Social Security and RR benefits (Tier I, II and supplemental) included in line 1 above . . . . . . . . . . . . . . . . . .

11 . ________________________

12. Income received during period of nonresidence (See Instruction 26 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 . ________________________

13. Subtractions from attached Form 502SU . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . .

13 . _________________________

14. Two-income subtraction from worksheet in Instruction 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14 . ________________________

15. Total subtractions from Maryland income (Add lines 8 through 14 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15 . ________________________

16. Maryland adjusted gross income (Subtract line 15 from line 7 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16 . ________________________

(All taxpayers must select one method and check the appropriate box.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

STANDARD DEDUCTION METHOD (Enter amount on line 17 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ITEMIZED DEDUCTION METHOD (Complete lines 17a and 17b .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17a. Total federal itemized deductions (from line 29, federal Schedule A) . . . . . . . . . . . . . . . .

17a . ___________________________

17b. State and local income taxes (See Instruction 14 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17b . ___________________________

Subtract line 17b from line 17a and enter amount on line 17 .

17. Deduction amount (Part-year residents see Instruction 26 (l and m) .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17 . ________________________

18. Net income (Subtract line 17 from line 16 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18 . ________________________

19. Exemption amount from Exemptions area above (See Instruction 10 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19 . ________________________

20. Taxable net income (Subtract line 19 from line 18 .) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20 . ________________________

COM/RAD-009

1

1 2

2 3

3 4

4