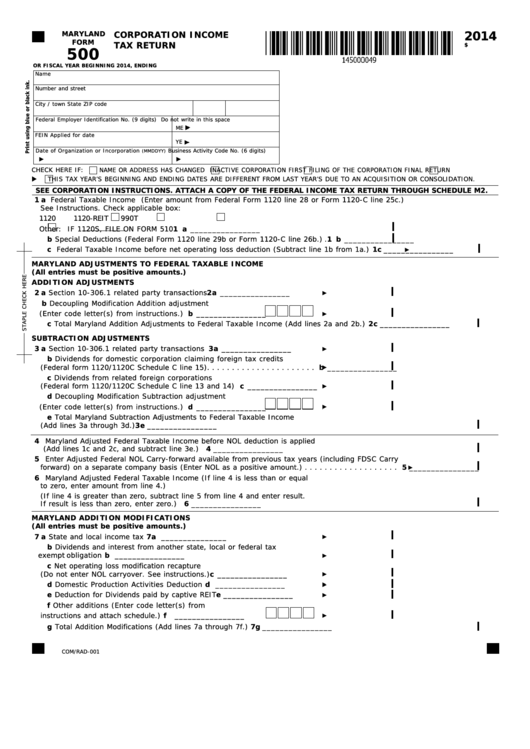

2014

MARYLAND

CORPORATION INCOME

FORM

TAX RETURN

$

500

OR FISCAL YEAR BEGINNING

2014, ENDING

Name

Number and street

City / town

State

ZIP code

Federal Employer Identification No. (9 digits)

Do not write in this space

ME

FEIN Applied for date

YE

Date of Organization or Incorporation

Business Activity Code No. (6 digits)

(MMDDYY)

CHECK HERE IF:

NAME OR ADDRESS HAS CHANGED

INACTIVE CORPORATION

FIRST FILING OF THE CORPORATION

FINAL RETURN

THIS TAX YEAR’S BEGINNING AND ENDING DATES ARE DIFFERENT FROM LAST YEAR’S DUE TO AN ACQUISITION OR CONSOLIDATION.

SEE CORPORATION INSTRUCTIONS. ATTACH A COPY OF THE FEDERAL INCOME TAX RETURN THROUGH SCHEDULE M2.

1 a Federal Taxable Income (Enter amount from Federal Form 1120 line 28 or Form 1120-C line 25c.)

See Instructions. Check applicable box:

1120

1120-REIT

990T

IF 1120S, FILE ON FORM 510 . . . . . . . . . . . . . . . . . 1 a ________________

Other:

b Special Deductions (Federal Form 1120 line 29b or Form 1120-C line 26b.) . 1 b ________________

c Federal Taxable Income before net operating loss deduction (Subtract line 1b from 1a.) . . . . . . .

1c ________________

MARYLAND ADJUSTMENTS TO FEDERAL TAXABLE INCOME

(All entries must be positive amounts.)

ADDITION ADJUSTMENTS

2 a Section 10-306.1 related party transactions . . . . . . . . . . . . . . . . . . . . . . . 2a ________________

b Decoupling Modification Addition adjustment

b ________________

(Enter code letter(s) from instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . .

c Total Maryland Addition Adjustments to Federal Taxable Income (Add lines 2a and 2b.) . . . . . . . . . 2c ________________

SUBTRACTION ADJUSTMENTS

3 a Section 10-306.1 related party transactions . . . . . . . . . . . . . . . . . . . . . . . 3a ________________

b Dividends for domestic corporation claiming foreign tax credits

(Federal form 1120/1120C Schedule C line 15). . . . . . . . . . . . . . . . . . . . . .

b ________________

c Dividends from related foreign corporations

c ________________

(Federal form 1120/1120C Schedule C line 13 and 14) . . . . . . . . . . . . . . . .

d Decoupling Modification Subtraction adjustment

(Enter code letter(s) from instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . .

d ________________

e Total Maryland Subtraction Adjustments to Federal Taxable Income

(Add lines 3a through 3d.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3e ________________

4 Maryland Adjusted Federal Taxable Income before NOL deduction is applied

4 ________________

(Add lines 1c and 2c, and subtract line 3e.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Enter Adjusted Federal NOL Carry-forward available from previous tax years (including FDSC Carry

forward) on a separate company basis (Enter NOL as a positive amount.) . . . . . . . . . . . . . . . . . . .

5 ________________

6 Maryland Adjusted Federal Taxable Income (If line 4 is less than or equal

to zero, enter amount from line 4.)

(If line 4 is greater than zero, subtract line 5 from line 4 and enter result.

6 ________________

If result is less than zero, enter zero.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

MARYLAND ADDITION MODIFICATIONS

(All entries must be positive amounts.)

7 a State and local income tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7a _______________

b Dividends and interest from another state, local or federal tax

exempt obligation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b ________________

c Net operating loss modification recapture

(Do not enter NOL carryover. See instructions.) . . . . . . . . . . . . . . . . . . . . .

c ________________

d Domestic Production Activities Deduction . . . . . . . . . . . . . . . . . . . . . . . . .

d ________________

e Deduction for Dividends paid by captive REIT . . . . . . . . . . . . . . . . . . . . . .

e ________________

f Other additions (Enter code letter(s) from

instructions and attach schedule.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

f ________________

g Total Addition Modifications (Add lines 7a through 7f.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7g ________________

COM/RAD-001

1

1 2

2 3

3