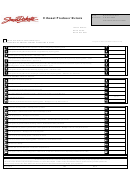

Form 592 - South Dakota Ethanol Producer Return Page 3

ADVERTISEMENT

schedule must match the number that is authorized for the transaction that is taking place.

For example, if the purchaser is buying the product for export, the number entered for that

transaction must be the purchaser’s current Exporters license number with the state. If they

are just marketing the fuel, the license number must be the purchasers’ current Marketers

license number with the state. The correct schedule type must also be entered for each

transaction.

Allowances

Ethanol Producers who properly remit tax as discussed earlier are allowed to retain an

amount equal to two and one-fourth percent (2.25 percent) of the tax due on each gallon of

fuel withdrawn from the rack. The Ethanol Producer may keep one-third of this amount

(.75 percent) to help offset the administrative expenses involved in reporting and remitting

taxes. The remaining two-thirds (1.5 percent) is passed on to the customer who withdrew

the fuel.

If an Ethanol Producer is late in submitting the monthly return or remitting the taxes due,

the Ethanol Producer may not retain any of the 2.25 percent allowance. If a customer is late

in paying the fuel tax owed, the Ethanol Producer may retain the entire 2.25 percent

allowance.

Payment and Reporting Schedule

All fuel tax due from an Ethanol Producer must be remitted to the Department of Revenue

& Regulation on or before the last day of the month following the month in which the fuel

was sold. A monthly tax return must be submitted at the same time. For example, an

Ethanol Producer would remit all tax collected in September by October 31st. If the last

day of the month falls on a Sunday or legal holiday, the tax and report are due on the next

business day.

Ethanol Incentive Payments

Licensed Ethanol Producers may receive a production incentive payment (based on

available funding) of 20 cents per gallon for ethyl alcohol that is fully distilled and

produced in South Dakota. To be eligible for this payment, the ethyl alcohol must be

ninety-nine percent pure, derived from agricultural products, be denatured and

subsequently blended with gasoline.

Annual production incentive payments for any facility may not exceed $1 million. No

facility may receive any production incentive payments in an amount greater than $10

million dollars.

Refunds

Ethanol Producers may obtain a refund of the taxes paid for natural gasoline and/or

gasoline that is used to denature alcohol. This refund can be claimed on the Ethanol

Producer tax return.

37

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5