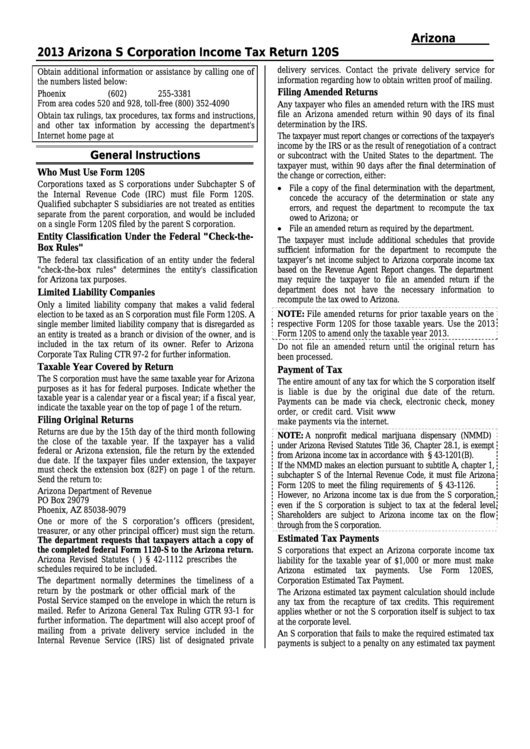

Arizona Form 120s - S Corporation Income Tax Return - 2013

ADVERTISEMENT

Arizona Form

2013 Arizona S Corporation Income Tax Return

120S

delivery services. Contact the private delivery service for

Obtain additional information or assistance by calling one of

information regarding how to obtain written proof of mailing.

the numbers listed below:

Filing Amended Returns

Phoenix

(602) 255-3381

From area codes 520 and 928, toll-free

(800) 352-4090

Any taxpayer who files an amended return with the IRS must

file an Arizona amended return within 90 days of its final

Obtain tax rulings, tax procedures, tax forms and instructions,

determination by the IRS.

and other tax information by accessing the department's

Internet home page at

The taxpayer must report changes or corrections of the taxpayer's

income by the IRS or as the result of renegotiation of a contract

General Instructions

or subcontract with the United States to the department. The

taxpayer must, within 90 days after the final determination of

Who Must Use Form 120S

the change or correction, either:

Corporations taxed as S corporations under Subchapter S of

File a copy of the final determination with the department,

the Internal Revenue Code (IRC) must file Form 120S.

concede the accuracy of the determination or state any

Qualified subchapter S subsidiaries are not treated as entities

errors, and request the department to recompute the tax

separate from the parent corporation, and would be included

owed to Arizona; or

on a single Form 120S filed by the parent S corporation.

File an amended return as required by the department.

Entity Classification Under the Federal "Check-the-

The taxpayer must include additional schedules that provide

Box Rules"

sufficient information for the department to recompute the

The federal tax classification of an entity under the federal

taxpayer’s net income subject to Arizona corporate income tax

"check-the-box rules" determines the entity's classification

based on the Revenue Agent Report changes. The department

for Arizona tax purposes.

may require the taxpayer to file an amended return if the

department does not have the necessary information to

Limited Liability Companies

recompute the tax owed to Arizona.

Only a limited liability company that makes a valid federal

NOTE: File amended returns for prior taxable years on the

election to be taxed as an S corporation must file Form 120S. A

respective Form 120S for those taxable years. Use the 2013

single member limited liability company that is disregarded as

Form 120S to amend only the taxable year 2013.

an entity is treated as a branch or division of the owner, and is

included in the tax return of its owner. Refer to Arizona

Do not file an amended return until the original return has

Corporate Tax Ruling CTR 97-2 for further information.

been processed.

Taxable Year Covered by Return

Payment of Tax

The S corporation must have the same taxable year for Arizona

The entire amount of any tax for which the S corporation itself

purposes as it has for federal purposes. Indicate whether the

is liable is due by the original due date of the return.

taxable year is a calendar year or a fiscal year; if a fiscal year,

Payments can be made via check, electronic check, money

indicate the taxable year on the top of page 1 of the return.

order, or credit card. Visit to register and

Filing Original Returns

make payments via the internet.

Returns are due by the 15th day of the third month following

NOTE: A nonprofit medical marijuana dispensary (NMMD)

the close of the taxable year. If the taxpayer has a valid

under Arizona Revised Statutes Title 36, Chapter 28.1, is exempt

federal or Arizona extension, file the return by the extended

from Arizona income tax in accordance with A.R.S. § 43-1201(B).

due date. If the taxpayer files under extension, the taxpayer

If the NMMD makes an election pursuant to subtitle A, chapter 1,

must check the extension box (82F) on page 1 of the return.

subchapter S of the Internal Revenue Code, it must file Arizona

Send the return to:

Form 120S to meet the filing requirements of A.R.S. § 43-1126.

Arizona Department of Revenue

However, no Arizona income tax is due from the S corporation,

PO Box 29079

even if the S corporation is subject to tax at the federal level.

Phoenix, AZ 85038-9079

Shareholders are subject to Arizona income tax on the flow

One or more of the S corporation’s officers (president,

through from the S corporation.

treasurer, or any other principal officer) must sign the return.

Estimated Tax Payments

The department requests that taxpayers attach a copy of

the completed federal Form 1120-S to the Arizona return.

S corporations that expect an Arizona corporate income tax

Arizona Revised Statutes (A.R.S.) § 42-1112 prescribes the

liability for the taxable year of $1,000 or more must make

schedules required to be included.

Arizona

estimated

tax

payments.

Use

Form 120ES,

The department normally determines the timeliness of a

Corporation Estimated Tax Payment.

return by the postmark or other official mark of the U.S.

The Arizona estimated tax payment calculation should include

Postal Service stamped on the envelope in which the return is

any tax from the recapture of tax credits. This requirement

mailed. Refer to Arizona General Tax Ruling GTR 93-1 for

applies whether or not the S corporation itself is subject to tax

further information. The department will also accept proof of

at the corporate level.

mailing from a private delivery service included in the

An S corporation that fails to make the required estimated tax

Internal Revenue Service (IRS) list of designated private

payments is subject to a penalty on any estimated tax payment

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12