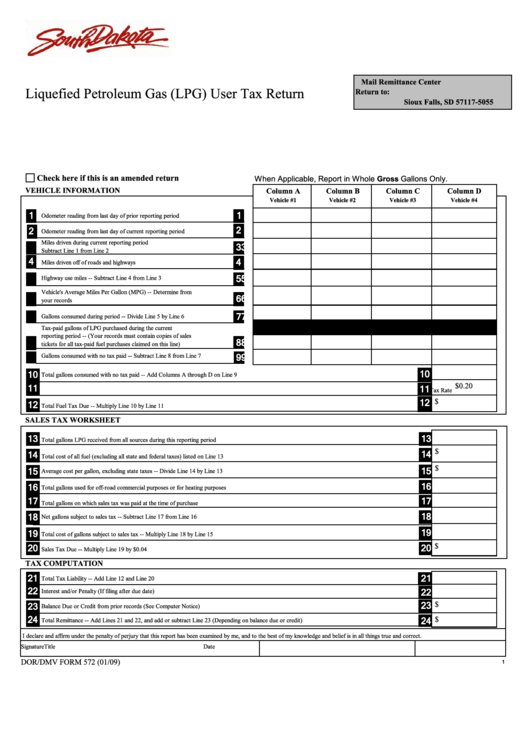

Form 572 - South Dakota Liquefied Petroleum Gas (Lpg) User Tax Return

ADVERTISEMENT

Mail

Remittance Center

Liquefied Petroleum Gas (LPG) User Tax Return

Return to:

P.O. Box 5055

Sioux Falls, SD 57117-5055

Check here if this is an amended return

When Applicable, Report in Whole Gross Gallons Only.

VEHICLE INFORMATION

Column A

Column B

Column C

Column D

Vehicle #1

Vehicle #2

Vehicle #3

Vehicle #4

1

1

Odometer reading from last day of prior reporting period

2

2

Odometer reading from last day of current reporting period

Miles driven during current reporting period

3

3

Subtract Line 1 from Line 2

4

4

Miles driven off of roads and highways

5

5

Highway use miles -- Subtract Line 4 from Line 3

Vehicle's Average Miles Per Gallon (MPG) -- Determine from

6

6

your records

7

7

Gallons consumed during period -- Divide Line 5 by Line 6

Tax-paid gallons of LPG purchased during the current

reporting period -- (Your records must contain copies of sales

8

8

tickets for all tax-paid fuel purchases claimed on this line)

9

9

Gallons consumed with no tax paid -- Subtract Line 8 from Line 7

10

10

Total gallons consumed with no tax paid -- Add Columns A through D on Line 9

$0.20

11

11

Tax Rate

$

12

12

Total Fuel Tax Due -- Multiply Line 10 by Line 11

SALES TAX WORKSHEET

13

13

Total gallons LPG received from all sources during this reporting period

$

14

14

Total cost of all fuel (excluding all state and federal taxes) listed on Line 13

$

15

15

Average cost per gallon, excluding state taxes -- Divide Line 14 by Line 13

16

16

Total gallons used for off-road commercial purposes or for heating purposes

17

17

Total gallons on which sales tax was paid at the time of purchase

18

18

Net gallons subject to sales tax -- Subtract Line 17 from Line 16

19

19

Total cost of gallons subject to sales tax -- Multiply Line 18 by Line 15

$

20

20

Sales Tax Due -- Multiply Line 19 by $0.04

TAX COMPUTATION

21

21

Total Tax Liability -- Add Line 12 and Line 20

22

22

Interest and/or Penalty (If filing after due date)

$

23

23

Balance Due or Credit from prior records (See Computer Notice)

24

$

24

Total Remittance -- Add Lines 21 and 22, and add or subtract Line 23 (Depending on balance due or credit)

I declare and affirm under the penalty of perjury that this report has been examined by me, and to the best of my knowledge and belief is in all things true and correct.

Signature

Title

Date

DOR/DMV FORM 572 (01/09)

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1