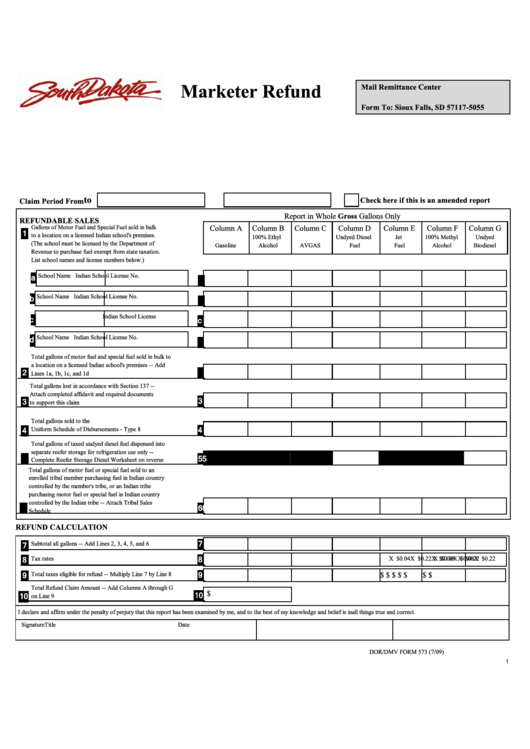

Marketer Refund

Mail

Remittance Center

Refund

P.O. Box 5055

Form To:

Sioux Falls, SD 57117-5055

to

Check here if this is an amended report

Claim Period From

Report in Whole Gross Gallons Only

REFUNDABLE SALES

Gallons of Motor Fuel and Special Fuel sold in bulk

Column A

Column B

Column C

Column D

Column E

Column F

Column G

1

to a location on a licensed Indian school's premises.

100% Ethyl

Undyed Diesel

Jet

100% Methyl

Undyed

(The school must be licensed by the Department of

Gasoline

Alcohol

AVGAS

Fuel

Fuel

Alcohol

Biodiesel

Revenue to purchase fuel exempt from state taxation.

List school names and license numbers below.)

School Name

Indian School License No.

a

a

School Name

Indian School License No.

b

b

School Name

Indian School License No.

c

c

School Name

Indian School License No.

d

d

Total gallons of motor fuel and special fuel sold in bulk to

a location on a licensed Indian school's premises -- Add

2

2

Lines 1a, 1b, 1c, and 1d

Total gallons lost in accordance with Section 137 --

Attach completed affidavit and required documents

3

3

to support this claim

Total gallons sold to the U.S. Government -- Attach

Uniform Schedule of Disbursements - Type 8

4

4

Total gallons of taxed undyed diesel fuel dispensed into

separate reefer storage for refrigeration use only --

5

5

Complete Reefer Storage Diesel Worksheet on reverse

Total gallons of motor fuel or special fuel sold to an

enrolled tribal member purchasing fuel in Indian country

controlled by the member's tribe, or an Indian tribe

purchasing motor fuel or special fuel in Indian country

controlled by the Indian tribe -- Attach Tribal Sales

6

6

Schedule

REFUND CALCULATION

7

Subtotal all gallons -- Add Lines 2, 3, 4, 5, and 6

7

Tax rates

8

X $0.22

X $0.08

X $0.06

X $0.22

X $0.04

X $0.08

X $0.22

8

Total taxes eligible for refund -- Multiply Line 7 by Line 8

9

$

$

$

$

$

$

$

9

Total Refund Claim Amount -- Add Columns A through G

$

10

10

on Line 9

I declare and affirm under the penalty of perjury that this report has been examined by me, and to the best of my knowledge and belief is inall things true and correct.

Signature

Title

Date

DOR/DMV FORM 573 (7/09)

1

1

1 2

2