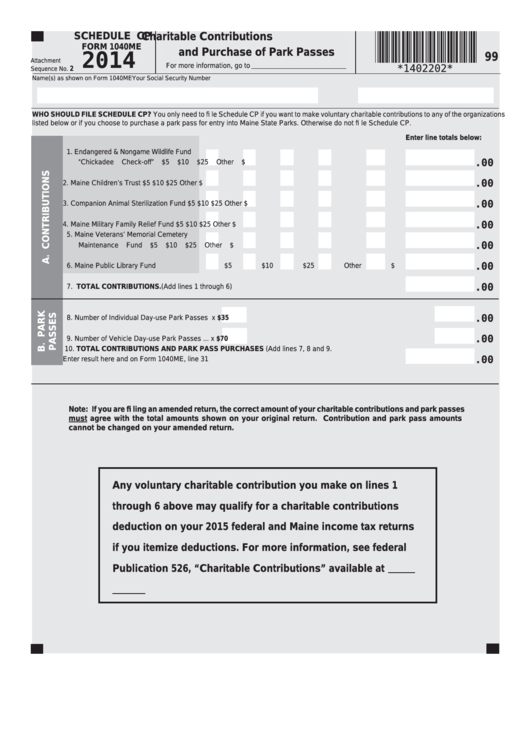

SCHEDULE CP

Charitable Contributions

FORM 1040ME

and Purchase of Park Passes

99

2014

Attachment

For more information, go to

*1402202*

2

Sequence No.

Name(s) as shown on Form 1040ME

Your Social Security Number

WHO SHOULD FILE SCHEDULE CP? You only need to fi le Schedule CP if you want to make voluntary charitable contributions to any of the organizations

listed below or if you choose to purchase a park pass for entry into Maine State Parks. Otherwise do not fi le Schedule CP.

Enter line totals below:

1. Endangered & Nongame Wildlife Fund

“Chickadee Check-off”

$5

$10

$25

Other $ .......... 1

.00

2. Maine Children’s Trust

$5

$10

$25

Other $ ............ 2

.00

3. Companion Animal Sterilization Fund

$5

$10

$25

Other $ ............ 3

.00

4. Maine Military Family Relief Fund

$5

$10

$25

Other $ ............ 4

.00

5. Maine Veterans’ Memorial Cemetery

Maintenance Fund

$5

$10

$25

Other $ ............ 5

.00

6. Maine Public Library Fund

$5

$10

$25

Other $ ............ 6

.00

7. TOTAL CONTRIBUTIONS. (Add lines 1 through 6) ............................................................................. 7

.00

8. Number of Individual Day-use Park Passes

x $35 ...................................................... 8

.00

9. Number of Vehicle Day-use Park Passes ...

x $70 ...................................................... 9

.00

10. TOTAL CONTRIBUTIONS AND PARK PASS PURCHASES (Add lines 7, 8 and 9.

Enter result here and on Form 1040ME, line 31 ................................................................................ 10

.00

Note: If you are fi ling an amended return, the correct amount of your charitable contributions and park passes

must agree with the total amounts shown on your original return. Contribution and park pass amounts

cannot be changed on your amended return.

Any voluntary charitable contribution you make on lines 1

through 6 above may qualify for a charitable contributions

deduction on your 2015 federal and Maine income tax returns

if you itemize deductions. For more information, see federal

Publication 526, “Charitable Contributions” available at www.

irs.gov.

1

1