Form Pit-Ext - New Mexico Personal Income Tax Extension Payment Voucher - 2014

ADVERTISEMENT

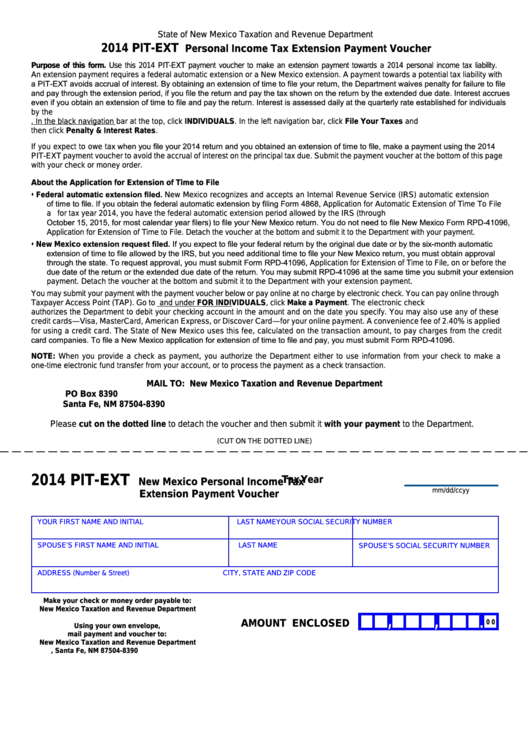

State of New Mexico Taxation and Revenue Department

2014 PIT-EXT

Personal Income Tax Extension Payment Voucher

Purpose of this form. Use this 2014 PIT-EXT payment voucher to make an extension payment towards a 2014 personal income tax liability.

An extension payment requires a federal automatic extension or a New Mexico extension. A payment towards a potential tax liability with

a PIT-EXT avoids accrual of interest. By obtaining an extension of time to file your return, the Department waives penalty for failure to file

and pay through the extension period, if you file the return and pay the tax shown on the return by the extended due date. Interest accrues

even if you obtain an extension of time to file and pay the return. Interest is assessed daily at the quarterly rate established for individuals

by the U.S. Internal Revenue Code on the amount of tax due. The Department posts annual and daily interest rates for each quarter at

In the black navigation bar at the top, click INDIVIDUALS. In the left navigation bar, click File Your Taxes and

then click Penalty & Interest Rates.

If you expect to owe tax when you file your 2014 return and you obtained an extension of time to file, make a payment using the 2014

PIT-EXT payment voucher to avoid the accrual of interest on the principal tax due. Submit the payment voucher at the bottom of this page

with your check or money order.

About the Application for Extension of Time to File

Federal automatic extension filed. New Mexico recognizes and accepts an Internal Revenue Service (IRS) automatic extension

•

of time to file. If you obtain the federal automatic extension by filing Form 4868, Application for Automatic Extension of Time To File

a U.S. Individual Income Tax Return for tax year 2014, you have the federal automatic extension period allowed by the IRS (through

October 15, 2015, for most calendar year filers) to file your New Mexico return. You do not need to file New Mexico Form RPD-41096,

Application for Extension of Time to File. Detach the voucher at the bottom and submit it to the Department with your payment.

New Mexico extension request filed. If you expect to file your federal return by the original due date or by the six-month automatic

•

extension of time to file allowed by the IRS, but you need additional time to file your New Mexico return, you must obtain approval

through the state. To request approval, you must submit Form RPD-41096, Application for Extension of Time to File, on or before the

due date of the return or the extended due date of the return. You may submit RPD-41096 at the same time you submit your extension

payment. Detach the voucher at the bottom and submit it to the Department with your extension payment.

You may submit your payment with the payment voucher below or pay online at no charge by electronic check. You can pay online through

Taxpayer Access Point (TAP). Go to https://tap.state.nm.us and under FOR INDIVIDUALS, click Make a Payment. The electronic check

authorizes the Department to debit your checking account in the amount and on the date you specify. You may also use any of these

credit cards—Visa, MasterCard, American Express, or Discover Card—for your online payment. A convenience fee of 2.40% is applied

for using a credit card. The State of New Mexico uses this fee, calculated on the transaction amount, to pay charges from the credit

card companies. To file a New Mexico application for extension of time to file and pay, you must submit Form RPD-41096.

NOTE: When you provide a check as payment, you authorize the Department either to use information from your check to make a

one-time electronic fund transfer from your account, or to process the payment as a check transaction.

MAIL TO: New Mexico Taxation and Revenue Department

PO Box 8390

Santa Fe, NM 87504-8390

Please cut on the dotted line to detach the voucher and then submit it with your payment to the Department.

(CUT ON THE DOTTED LINE)

2014 PIT-EXT

Tax Year

New Mexico Personal Income Tax

Extension Payment Voucher

YOUR FIRST NAME AND INITIAL

LAST NAME

YOUR SOCIAL SECURITY NUMBER

SPOUSE’S FIRST NAME AND INITIAL

LAST NAME

SPOUSE’S SOCIAL SECURITY NUMBER

ADDRESS (Number & Street)

CITY, STATE AND ZIP CODE

Make your check or money order payable to:

New Mexico Taxation and Revenue Department

,

,

.

AMOUNT ENCLOSED

0 0

Using your own envelope,

mail payment and voucher to:

New Mexico Taxation and Revenue Department

P.O. Box 8390, Santa Fe, NM 87504-8390

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2