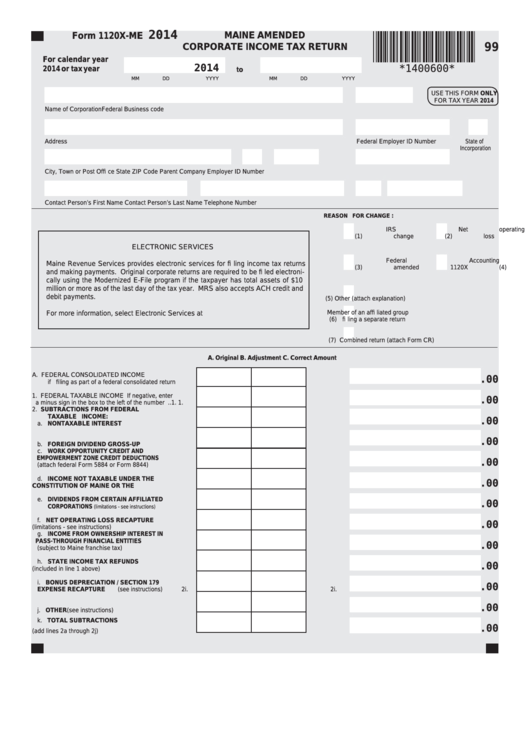

2014

MAINE AMENDED

Form 1120X-ME

CORPORATE INCOME TAX RETURN

99

For calendar year

2014

*1400600*

2014 or tax year

to

MM

DD

YYYY

MM

DD

YYYY

USE THIS FORM ONLY

FOR TAX YEAR 2014

Name of Corporation

Federal Business code

Address

Federal Employer ID Number

State of

Incorporation

City, Town or Post Offi ce

State

ZIP Code

Parent Company Employer ID Number

Contact Person’s First Name

Contact Person’s Last Name

Telephone Number

:

REASON FOR CHANGE

IRS

Net operating

(1)

change

(2)

loss

ELECTRONIC SERVICES

Federal

Accounting

Maine Revenue Services provides electronic services for fi ling income tax returns

(3)

amended 1120X

(4)

change

and making payments. Original corporate returns are required to be fi led electroni-

cally using the Modernized E-File program if the taxpayer has total assets of $10

million or more as of the last day of the tax year. MRS also accepts ACH credit and

debit payments.

(5)

Other (attach explanation)

Member of an affi liated group

For more information, select Electronic Services at

(6)

fi ling a separate return

(7)

Combined return (attach Form CR)

A. Original

B. Adjustment

C. Correct Amount

A.

FEDERAL CONSOLIDATED INCOME

.00

if fi ling as part of a federal consolidated return ......A.

A.

1.

FEDERAL TAXABLE INCOME If negative, enter

.00

a minus sign in the box to the left of the number .. 1.

1.

2.

SUBTRACTIONS FROM FEDERAL

TAXABLE INCOME:

.00

a. NONTAXABLE INTEREST ................................. 2a.

2a.

.00

b. FOREIGN DIVIDEND GROSS-UP....................... 2b.

2b.

c. WORK OPPORTUNITY CREDIT AND

EMPOWERMENT ZONE CREDIT DEDUCTIONS

.00

(attach federal Form 5884 or Form 8844) ............ 2c.

2c.

d. INCOME NOT TAXABLE UNDER THE

.00

CONSTITUTION OF MAINE OR THE U.S. ......... 2d.

2d.

e. DIVIDENDS FROM CERTAIN AFFILIATED

.00

CORPORATIONS

.............. 2e.

2e.

(limitations - see instructions)

f.

NET OPERATING LOSS RECAPTURE

.00

(limitations - see instructions) ................................ 2f.

2f.

g. INCOME FROM OWNERSHIP INTEREST IN

PASS-THROUGH FINANCIAL ENTITIES

.00

(subject to Maine franchise tax) ........................ 2g.

2g.

h. STATE INCOME TAX REFUNDS

.00

(included in line 1 above) ..................................... 2h.

2h.

i.

BONUS DEPRECIATION / SECTION 179

.00

EXPENSE RECAPTURE (see instructions) ........... 2i.

2i.

.00

j.

OTHER (see instructions) ................................... 2j.

2j.

k. TOTAL SUBTRACTIONS

.00

(add lines 2a through 2j) ..................................... 2k.

2k.

1

1 2

2 3

3 4

4 5

5 6

6