Form 6xmb - Amended Nebraska Sales And Use Tax Statement For Motorboat Sales

ADVERTISEMENT

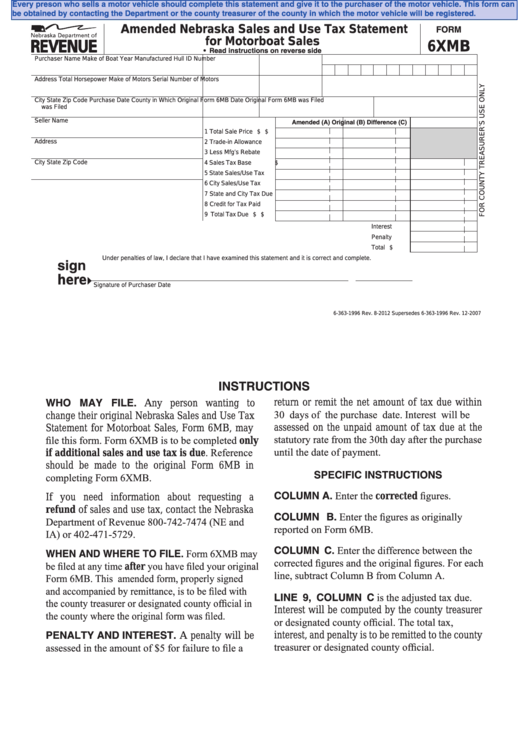

Every preson who sells a motor vehicle should complete this statement and give it to the purchaser of the motor vehicle. This form can

be obtained by contacting the Department or the county treasurer of the county in which the motor vehicle will be registered.

Amended Nebraska Sales and Use Tax Statement

FORM

for Motorboat Sales

6XMB

• Read instructions on reverse side

Purchaser Name

Make of Boat

Year Manufactured

Hull ID Number

Address

Total Horsepower

Make of Motors

Serial Number of Motors

City

State

Zip Code

Purchase Date

County in Which Original Form 6MB

Date Original Form 6MB was Filed

was Filed

Seller Name

Amended (A)

Original (B)

Difference (C)

1 Total Sale Price ........... $

$

Address

2 Trade-in Allowance ......

3 Less Mfg’s Rebate ......

City

State

Zip Code

4 Sales Tax Base ...........

$

5 State Sales/Use Tax ....

6 City Sales/Use Tax ......

7 State and City Tax Due

8 Credit for Tax Paid .......

9 Total Tax Due .............. $

$

Interest ........

Penalty .........

Total ............. $

Under penalties of law, I declare that I have examined this statement and it is correct and complete.

sign

here

Signature of Purchaser

Date

6-363-1996 Rev. 8-2012 Supersedes 6-363-1996 Rev. 12-2007

INSTRUCTIONS

WHO MAY FILE. Any person wanting to

return or remit the net amount of tax due within

30 days of the purchase date. Interest will be

change their original Nebraska Sales and Use Tax

assessed on the unpaid amount of tax due at the

Statement for Motorboat Sales, Form 6MB, may

statutory rate from the 30th day after the purchase

file this form. Form 6XMB is to be completed only

until the date of payment.

if additional sales and use tax is due. Reference

should be made to the original Form 6MB in

SPECIFIC INSTRUCTIONS

completing Form 6XMB.

COLUMN A. Enter the corrected figures.

If you need information about requesting a

refund of sales and use tax, contact the Nebraska

COLUMN B. Enter the figures as originally

Department of Revenue 800-742-7474 (NE and

reported on Form 6MB.

IA) or 402-471-5729.

COLUMN C. Enter the difference between the

WHEN AND WHERE TO FILE. Form 6XMB may

corrected figures and the original figures. For each

be filed at any time after you have filed your original

line, subtract Column B from Column A.

Form 6MB. This amended form, properly signed

and accompanied by remittance, is to be filed with

LINE 9, COLUMN C is the adjusted tax due.

the county treasurer or designated county official in

Interest will be computed by the county treasurer

the county where the original form was filed.

or designated county official. The total tax,

PENALTY AND INTEREST. A penalty will be

interest, and penalty is to be remitted to the county

treasurer or designated county official.

assessed in the amount of $5 for failure to file a

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1