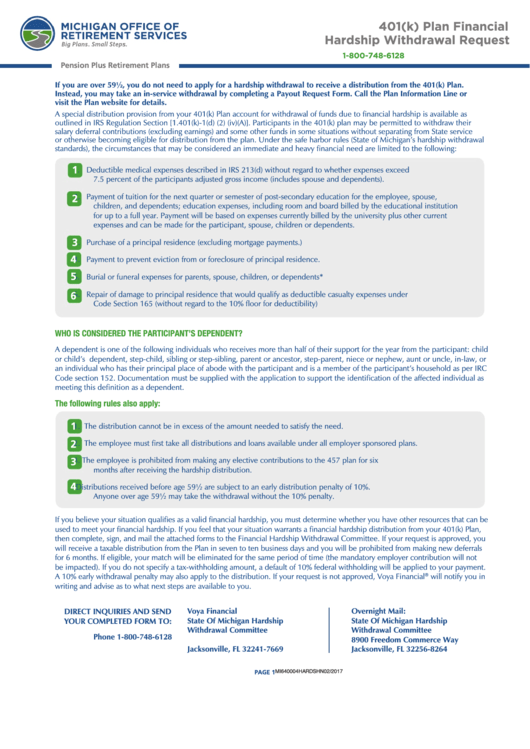

401(K) Plan Financial Hardship Withdrawal Request

ADVERTISEMENT

401(k) Plan Financial

Hardship Withdrawal Request

1-800-748-6128

Pension Plus Retirement Plans

If you are over 59½, you do not need to apply for a hardship withdrawal to receive a distribution from the 401(k) Plan.

Instead, you may take an in-service withdrawal by completing a Payout Request Form. Call the Plan Information Line or

visit the Plan website for details.

A special distribution provision from your 401(k) Plan account for withdrawal of funds due to financial hardship is available as

outlined in IRS Regulation Section [1.401(k)-1(d) (2) (iv)(A)]. Participants in the 401(k) plan may be permitted to withdraw their

salary deferral contributions (excluding earnings) and some other funds in some situations without separating from State service

or otherwise becoming eligible for distribution from the plan. Under the safe harbor rules (State of Michigan’s hardship withdrawal

standards), the circumstances that may be considered an immediate and heavy financial need are limited to the following:

1

1.

Deductible medical expenses described in IRS 213(d) without regard to whether expenses exceed

7.5 percent of the participants adjusted gross income (includes spouse and dependents).

2.

Payment of tuition for the next quarter or semester of post-secondary education for the employee, spouse,

2

children, and dependents; education expenses, including room and board billed by the educational institution

for up to a full year. Payment will be based on expenses currently billed by the university plus other current

expenses and can be made for the participant, spouse, children or dependents.

3

3.

Purchase of a principal residence (excluding mortgage payments.)

4

4.

Payment to prevent eviction from or foreclosure of principal residence.

5

5.

Burial or funeral expenses for parents, spouse, children, or dependents*

6.

Repair of damage to principal residence that would qualify as deductible casualty expenses under

6

Code Section 165 (without regard to the 10% floor for deductibility)

WHO IS CONSIDERED THE PARTICIPANT’S DEPENDENT?

A dependent is one of the following individuals who receives more than half of their support for the year from the participant: child

or child’s dependent, step-child, sibling or step-sibling, parent or ancestor, step-parent, niece or nephew, aunt or uncle, in-law, or

an individual who has their principal place of abode with the participant and is a member of the participant’s household as per IRC

Code section 152. Documentation must be supplied with the application to support the identification of the affected individual as

meeting this definition as a dependent.

The following rules also apply:

1

1.

The distribution cannot be in excess of the amount needed to satisfy the need.

2

2.

The employee must first take all distributions and loans available under all employer sponsored plans.

3

3.

The employee is prohibited from making any elective contributions to the 457 plan for six

months after receiving the hardship distribution.

4

Distributions received before age 59½ are subject to an early distribution penalty of 10%.

Anyone over age 59½ may take the withdrawal without the 10% penalty.

If you believe your situation qualifies as a valid financial hardship, you must determine whether you have other resources that can be

used to meet your financial hardship. If you feel that your situation warrants a financial hardship distribution from your 401(k) Plan,

then complete, sign, and mail the attached forms to the Financial Hardship Withdrawal Committee. If your request is approved, you

will receive a taxable distribution from the Plan in seven to ten business days and you will be prohibited from making new deferrals

for 6 months. If eligible, your match will be eliminated for the same period of time (the mandatory employer contribution will not

be impacted). If you do not specify a tax-withholding amount, a default of 10% federal withholding will be applied to your payment.

A 10% early withdrawal penalty may also apply to the distribution. If your request is not approved, Voya Financial

will notify you in

®

writing and advise as to what next steps are available to you.

Voya Financial

Overnight Mail:

DIRECT INQUIRIES AND SEND

State Of Michigan Hardship

State Of Michigan Hardship

YOUR COMPLETED FORM TO:

Withdrawal Committee

Withdrawal Committee

Phone 1-800-748-6128

P.O. Box 57669

8900 Freedom Commerce Way

Jacksonville, FL 32241-7669

Jacksonville, FL 32256-8264

02/2017

MI640004HARDSHN

PAGE 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4