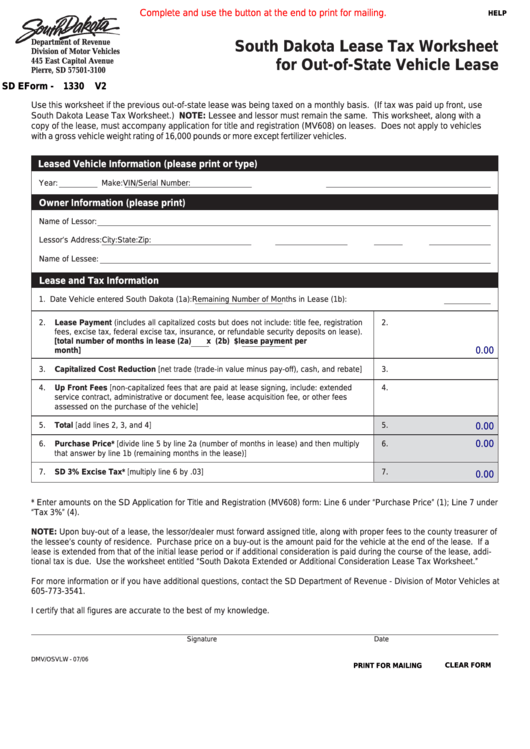

Complete and use the button at the end to print for mailing.

HELP

Department of Revenue

South Dakota Lease Tax Worksheet

Division of Motor Vehicles

445 East Capitol Avenue

for Out-of-State Vehicle Lease

Pierre, SD 57501-3100

SD EForm -

1330

V2

Use this worksheet if the previous out-of-state lease was being taxed on a monthly basis. (If tax was paid up front, use

South Dakota Lease Tax Worksheet.) NOTE: Lessee and lessor must remain the same. This worksheet, along with a

copy of the lease, must accompany application for title and registration (MV608) on leases. Does not apply to vehicles

with a gross vehicle weight rating of 16,000 pounds or more except fertilizer vehicles.

Leased Vehicle Information (please print or type)

Year:

Make:

VIN/Serial Number:

Owner Information (please print)

Name of Lessor:

Lessor’s Address:

City:

State:

Zip:

Name of Lessee:

Lease and Tax Information

1. Date Vehicle entered South Dakota (1a):

Remaining Number of Months in Lease (1b):

2.

Lease Payment (includes all capitalized costs but does not include: title fee, registration

2.

fees, excise tax, federal excise tax, insurance, or refundable security deposits on lease).

[total number of months in lease (2a)

x (2b) $

lease payment per

0.00

month]

3.

Capitalized Cost Reduction [net trade (trade-in value minus pay-off), cash, and rebate]

3.

4.

Up Front Fees [non-capitalized fees that are paid at lease signing, include: extended

4.

service contract, administrative or document fee, lease acquisition fee, or other fees

assessed on the purchase of the vehicle]

5.

Total [add lines 2, 3, and 4]

5.

0.00

0.00

6.

Purchase Price* [divide line 5 by line 2a (number of months in lease) and then multiply

6.

that answer by line 1b (remaining months in the lease)]

7.

SD 3% Excise Tax* [multiply line 6 by .03]

7.

0.00

* Enter amounts on the SD Application for Title and Registration (MV608) form: Line 6 under “Purchase Price” (1); Line 7 under

“Tax 3%” (4).

NOTE: Upon buy-out of a lease, the lessor/dealer must forward assigned title, along with proper fees to the county treasurer of

the lessee’s county of residence. Purchase price on a buy-out is the amount paid for the vehicle at the end of the lease. If a

lease is extended from that of the initial lease period or if additional consideration is paid during the course of the lease, addi-

tional tax is due. Use the worksheet entitled “South Dakota Extended or Additional Consideration Lease Tax Worksheet.”

For more information or if you have additional questions, contact the SD Department of Revenue - Division of Motor Vehicles at

605-773-3541.

I certify that all figures are accurate to the best of my knowledge.

Signature

Date

DMV/OSVLW - 07/06

CLEAR FORM

PRINT FOR MAILING

1

1