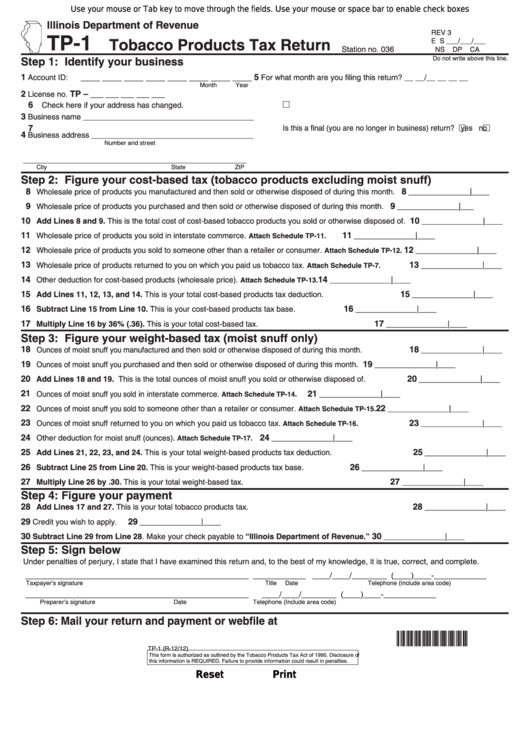

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

REV 3

TP-1

Tobacco Products Tax Return

E S ___/___/___

Station no. 036

NS

DP

CA

Step 1: Identify your business

Do not write above this line.

1

5

Account ID: ____ ____ ____ ____ ____ ____ ____ ____

For what month are you filing this return?

__ __/__ __ __ __

Month

Year

2

TP –

License no.

___ ___ ___ ___ ___

6

Check here if your address has changed.

3

Business name _______________________________________

7

Is this a final (you are no longer in business) return?

yes

no

4

Business address _____________________________________

Number and street

___________________________________________________

City

State

ZIP

Step 2: Figure your cost-based tax (tobacco products excluding moist snuff)

8

8

Wholesale price of products you manufactured and then sold or otherwise disposed of during this month.

______________|____

9

9

Wholesale price of products you purchased and then sold or otherwise disposed of during this month.

______________|___

10

10

Add Lines 8 and 9. This is the total cost of cost-based tobacco products you sold or otherwise disposed of.

______________|____

11

11

Wholesale price of products you sold in interstate commerce.

______________|____

Attach Schedule TP-11.

12

12

Wholesale price of products you sold to someone other than a retailer or consumer.

______________|____

Attach Schedule TP-12.

13

13

Wholesale price of products returned to you on which you paid us tobacco tax.

______________|____

Attach Schedule TP-7.

14

14

Other deduction for cost-based products (wholesale price).

______________|____

Attach Schedule TP-13.

15

15

Add Lines 11, 12, 13, and 14. This is your total cost-based products tax deduction.

______________|____

16

16

Subtract Line 15 from Line 10. This is your cost-based products tax base.

______________|____

17

17

Multiply Line 16 by 36% (.36). This is your total cost-based tax.

______________|____

Step 3: Figure your weight-based tax (moist snuff only)

18

18

Ounces of moist snuff you manufactured and then sold or otherwise disposed of during this month.

______________|____

19

19

Ounces of moist snuff you purchased and then sold or otherwise disposed of during this month.

______________|____

20

20

Add Lines 18 and 19. This is the total ounces of moist snuff you sold or otherwise disposed of.

______________|____

21

21

.

Ounces of moist snuff you sold in interstate commerce.

______________|____

Attach Schedule TP-14

22

22

Ounces of moist snuff you sold to someone other than a retailer or consumer.

______________|____

Attach Schedule TP-15.

23

23

Ounces of moist snuff returned to you on which you paid us tobacco tax.

______________|____

Attach Schedule TP-16.

24

24

Other deduction for moist snuff (ounces).

______________|____

Attach Schedule TP-17.

25

25

Add Lines 21, 22, 23, and 24. This is your total weight-based products tax deduction.

______________|____

26

26

Subtract Line 25 from Line 20. This is your weight-based products tax base.

______________|____

27

27

Multiply Line 26 by .30. This is your total weight-based tax.

______________|____

Step 4: Figure your payment

28

28

Add Lines 17 and 27. This is your total tobacco products tax.

______________|____

29

29

Credit you wish to apply.

______________|____

30

30

Subtract Line 29 from Line 28. Make your check payable to “Illinois Department of Revenue.”

______________|____

Step 5: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

___________________________________________________

____________

____/____/________ (____)____-____________

Taxpayer's signature

Title

Date

Telephone (Include area code)

___________________________________________________

____/____/________ (____)____-____________

Preparer's signature

Date

Telephone (Include area code)

Step 6: Mail your return and payment or webfile at tax.illinois.gov

2XXX21110

TP-1 (R-12/12)

This form is authorized as outlined by the Tobacco Products Tax Act of 1995. Disclosure of

this information is REQUIRED. Failure to provide information could result in penalties.

Reset

Print

1

1